💰 Manual vs. Automated Trading – Which Is More Profitable?

In the world of Forex trading, one of the biggest debates among traders is manual vs. automated trading. Both methods have their pros and cons, and each suits a different type of trader.

So, which one is more profitable? Let’s explore the key differences, benefits, and how to find the perfect balance between human skill and technology.

🧠 What Is Manual Trading?

Manual trading means that you, the trader, manually analyze the market, decide when to enter or exit trades, and manage positions yourself.

This approach relies on your own technical analysis, chart reading, and emotional discipline.

Advantages of Manual Trading:

- Full control over every trade

- Can adapt to changing market conditions

- Better for traders who love market analysis

Disadvantages:

- Emotion-driven decisions can lead to mistakes

- Time-consuming and stressful

- Hard to monitor the market 24/7

If you prefer to make your own decisions but want support, using a Forex Indicator can improve accuracy and reduce guesswork.

🤖 What Is Automated Trading?

Automated trading, also known as algorithmic or EA trading, uses pre-programmed strategies to trade for you.

A Forex EA (Expert Advisor) automatically opens and closes trades based on coded logic — no emotions, no hesitation.

These EAs run on MT4 and MT5 platforms, analyzing price action and executing trades faster than any human can.

Advantages of Automated Trading:

- Trades 24/7 without fatigue

- Removes emotional decision-making

- Backtest and optimize strategies easily

- Consistent and disciplined execution

Disadvantages:

- Relies on market conditions and EA quality

- Needs reliable VPS and stable internet

- Some EAs may perform well only in specific markets

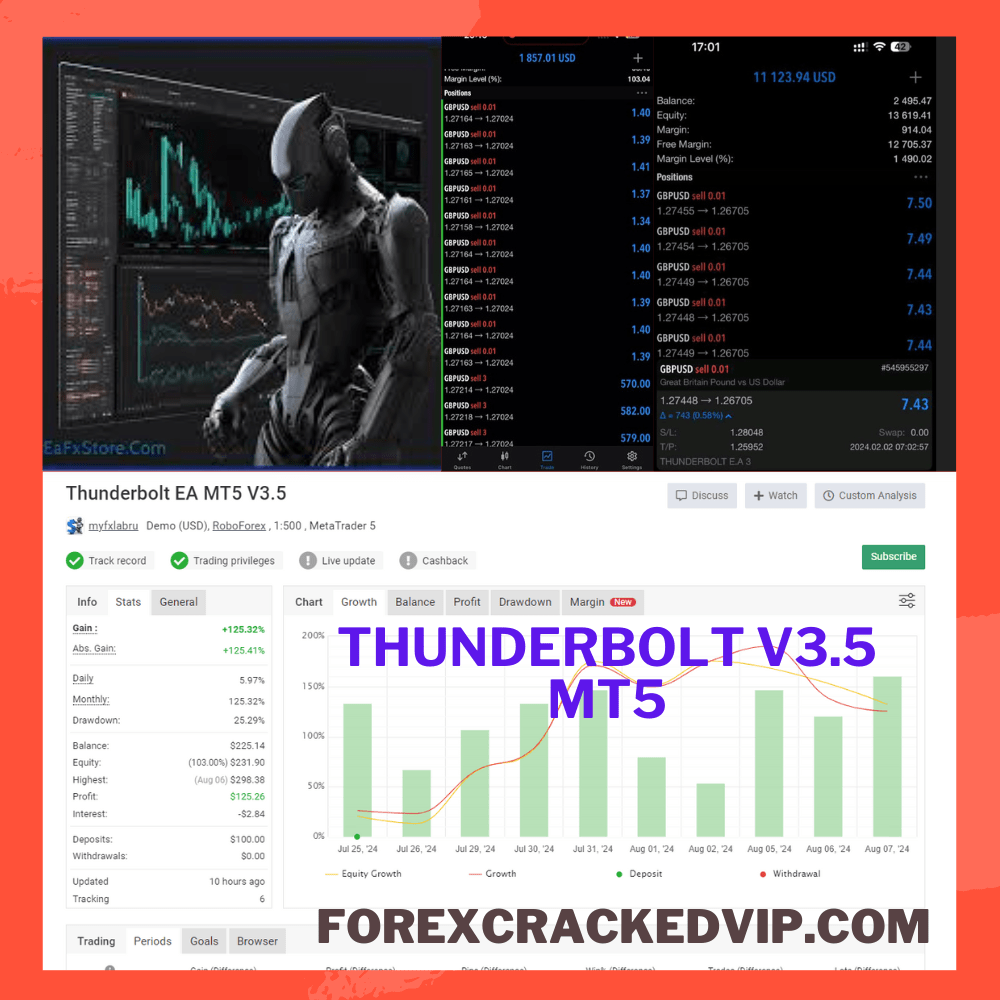

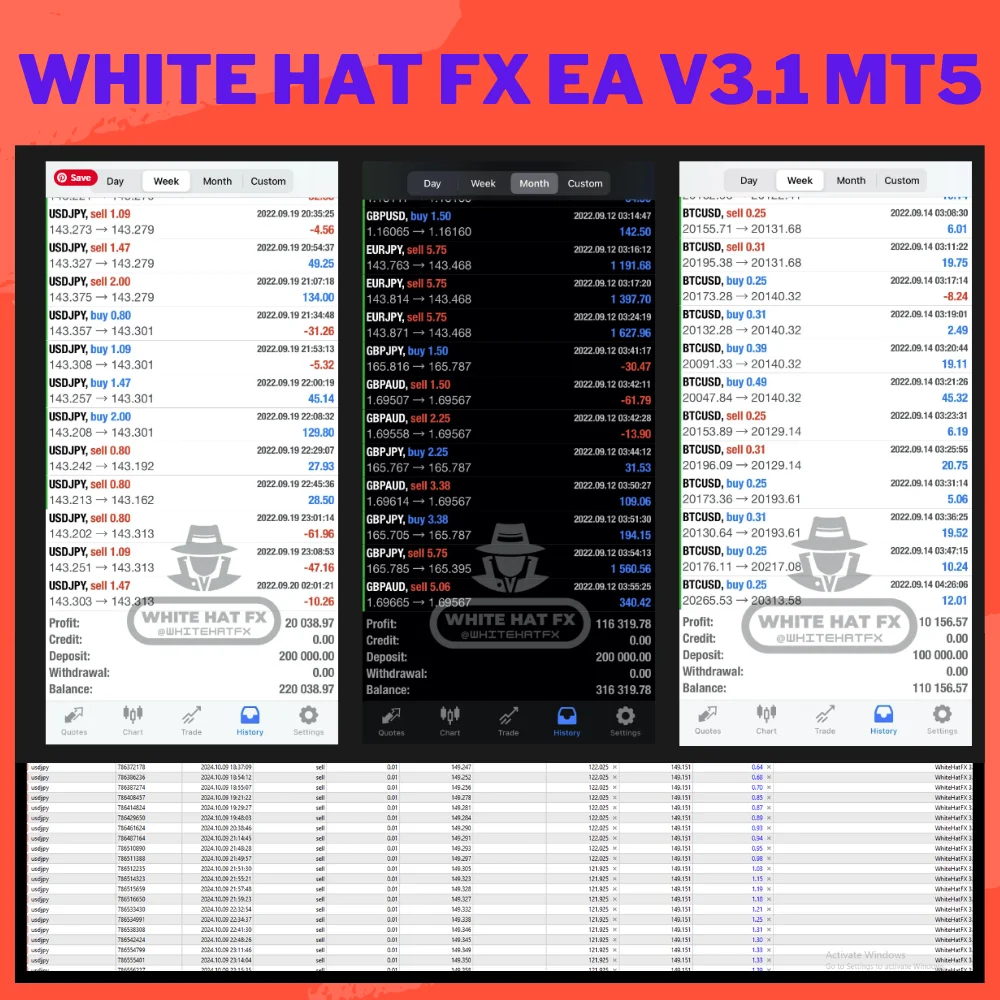

You can explore our tested and verified robots such as:

- Lock30x Gold Scalper Robot – Perfect for scalping gold with low drawdown.

- AGI EA MT4 – Advanced AI-driven EA with excellent long-term performance.

- Quantum Dark Gold EA – Ideal for high-volatility gold trading.

⚖️ Comparing Manual vs. Automated Trading

| Feature | Manual Trading | Automated Trading |

|---|---|---|

| Control | Full control | Limited (based on EA logic) |

| Emotion | Emotional decisions possible | Emotion-free |

| Speed | Slower execution | Instant execution |

| Monitoring | Constant attention needed | Works 24/7 |

| Adaptability | Can adapt to unexpected events | Depends on EA coding |

| Profit Potential | Depends on trader skill | Depends on EA strategy & risk settings |

For most traders, automated systems like Low Drawdown EAs provide a better long-term advantage due to consistent performance and reduced emotional bias.

📊 What About Profitability?

Profitability depends on risk management, market conditions, and strategy quality — not just the method.

- Skilled manual traders can outperform robots during fundamental events or volatile news.

- However, top-performing Forex Robots often outperform manual traders in terms of consistency, discipline, and overall returns over time.

At ForexCrackedVIP, we regularly test and publish verified results on Myfxbook — so you can see which EAs perform best in real market conditions.

💡 The Best Approach – Combine Both!

The most successful traders often combine manual and automated trading:

- Use manual analysis to understand the market direction.

- Deploy EAs to handle execution and risk management automatically.

For example:

- Use a trend-based indicator like Forex Profit Monster for manual confirmation.

- Pair it with an automated EA like Zeus Gold Hedge EA for continuous profit generation.

🧩 Setup & Support

If you’re new to EAs or need help with installation, our setup support team is ready to assist on Telegram → @MY4systemsofficial

You can also enjoy Free EA downloads and premium systems through our VIP Membership.

🚀 Final Thoughts

So, manual vs. automated trading – which is more profitable?

✅ Automated trading wins in consistency, discipline, and long-term performance.

However, manual trading still plays a crucial role for experienced traders who understand market psychology.

The ideal choice? Combine both to maximize results!

Explore hundreds of verified Forex EAs and Forex Indicators on forexcrackedvip.com — and take your trading to the next level.

💬 Setup Support: @MY4systemsofficial

🎁 Free Download Zone: ForexCracked VIP Membership

About admin

Best Selling Products

-

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$24.99Current price is: $24.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$19.99Current price is: $19.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$599.00Original price was: $599.00.$0.00Current price is: $0.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,399.00Original price was: $1,399.00.$24.99Current price is: $24.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$55.00Current price is: $55.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,599.00Original price was: $1,599.00.$39.99Current price is: $39.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$2,500.00Original price was: $2,500.00.$19.99Current price is: $19.99.