💡 How to Choose the Right Forex EA for Your Trading Style

In toIn today’s fast-paced Forex market, automated trading systems — also known as Forex EAs (Expert Advisors) — have become essential tools for traders who want to save time, eliminate emotions, and trade smarter.

But with hundreds of Forex robots available, how do you choose the right one that truly fits your trading style?

In this article, we’ll guide you through the key factors to consider when selecting the perfect EA for your goals.

🧠 What Is a Forex EA?

A Forex EA (Expert Advisor) is software that automatically opens and closes trades on your behalf based on a pre-defined strategy.

These robots run on MT4 or MT5 platforms and can execute trades much faster than any human.

👉 Explore our full range of MT4 EAs and MT5 EAs.

📊 Step 1: Identify Your Trading Style

Before picking an EA, you must understand your trading style. Different robots are optimized for different market approaches:

| Trading Style | Description | Ideal EA |

|---|---|---|

| Scalping | Quick in-and-out trades capturing small profits | Lock30x Gold Scalper, Orion Gold Scalper |

| Swing Trading | Holding trades for several days to capture medium trends | Dominant EA, AGI EA |

| Long-Term / Position Trading | Focus on fundamental and trend-based setups | Zeus Gold Hedge EA |

| News or High Volatility Trading | Executes trades during news events | Quantum Dark Gold EA |

Each style requires a different risk tolerance and time commitment.

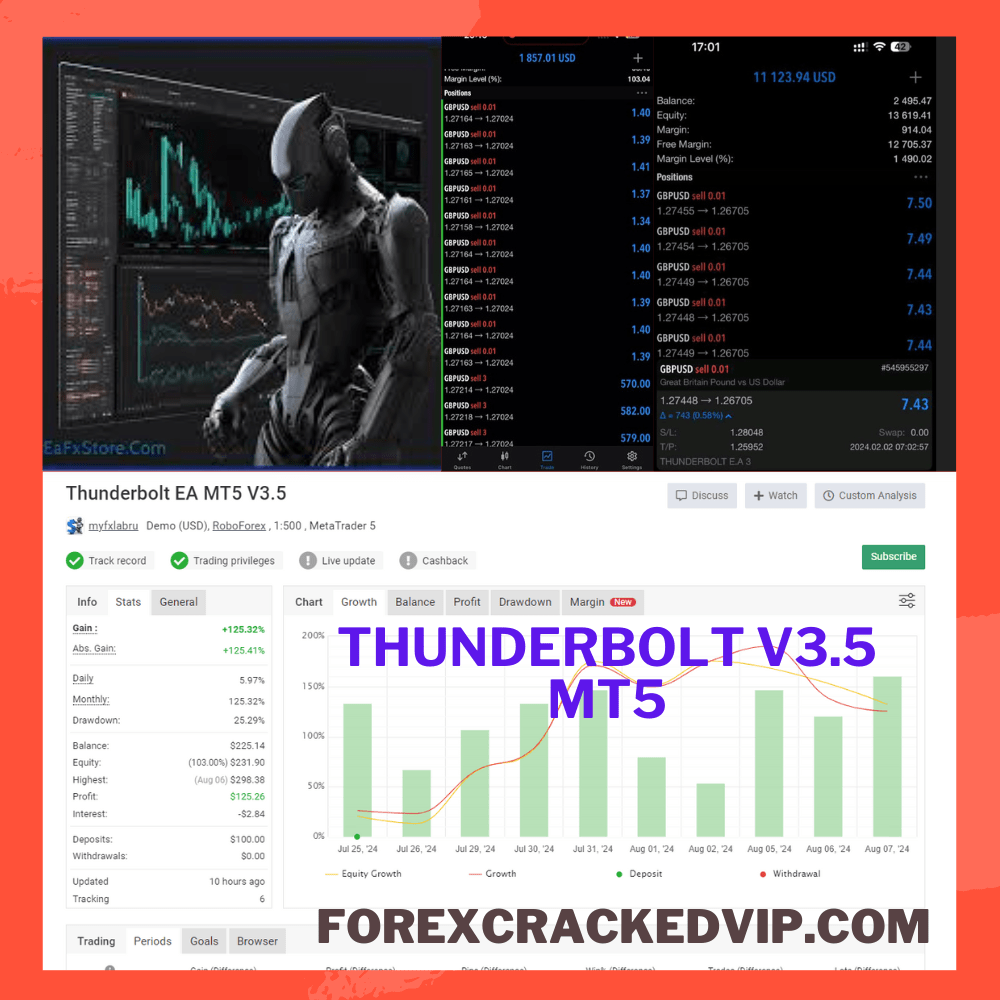

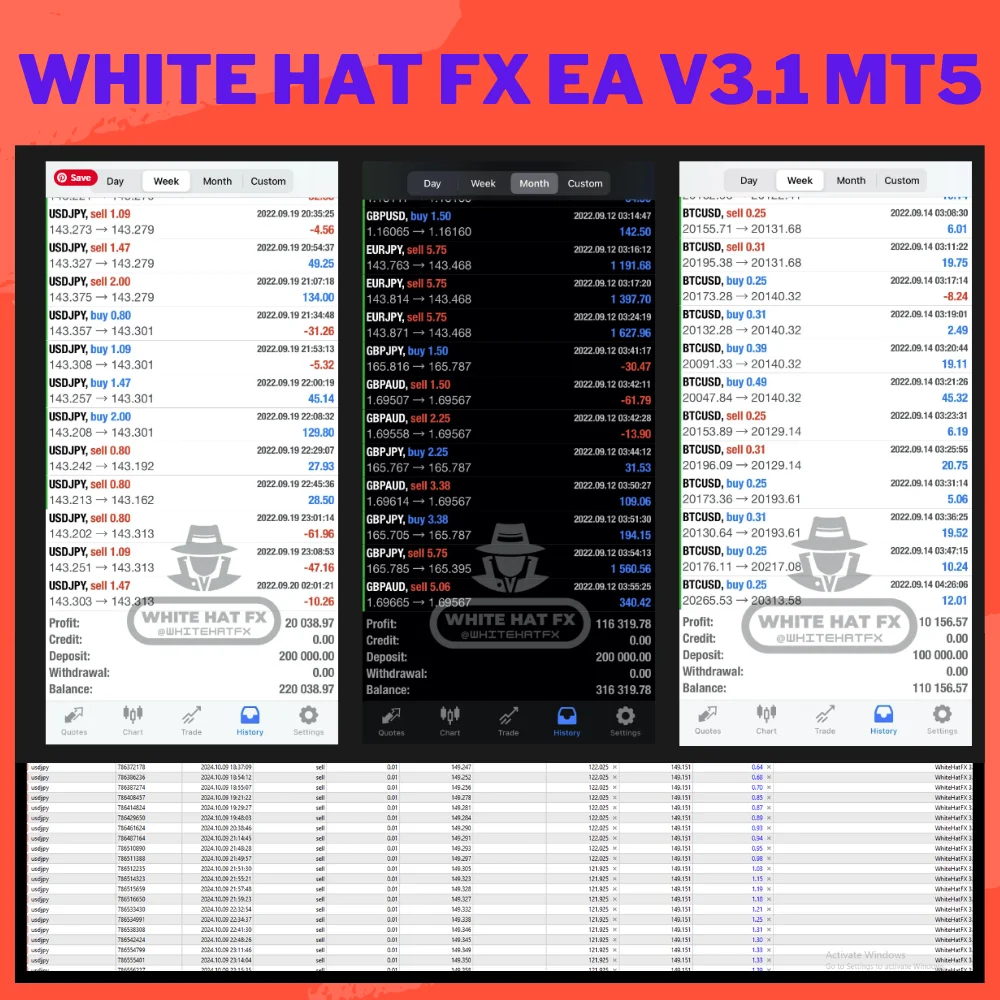

⚙️ Step 2: Check Real Performance Results

Always look for verified performance on trusted platforms like Myfxbook.

Real account tracking proves that the EA performs under live market conditions.

Avoid EAs that only show demo or backtest results — those are often misleading.

✅ Tip: At ForexCrackedVIP, we only feature tested and verified low drawdown EAs with real performance history.

💵 Step 3: Evaluate Risk and Drawdown

The best EA isn’t always the one with the highest profit — it’s the one that manages risk effectively.

Check the maximum drawdown, risk-per-trade settings, and money management system.

If you prefer safer trading, explore our low drawdown EA collection that focuses on stability and protection.

🧩 Step 4: Compatibility and Customization

Choose an EA that matches your platform (MT4 or MT5) and allows custom settings such as:

- Lot size

- Risk percentage

- Timeframes

- Trading sessions

Some EAs come with optimized set files for easier installation.

If you need help, our setup support team is available on Telegram → @MY4systemsofficial

🚀 Step 5: Test Before Going Live

Never jump into live trading without testing first.

Run your EA on a demo account for at least two weeks to see how it performs in different market conditions.

Use a reliable VPS to ensure your EA runs 24/7 without interruptions.

You can explore our collection of tested robots like TPC Bot MT5, MM Flip CodePro EA, and AIMaxPro EA MT4 — all designed for continuous and efficient performance.

🧠 Step 6: Match the EA to Your Risk Personality

Your personality plays a huge role in EA selection:

- Prefer low risk? → Choose hedging EAs like Zeus Gold Hedge EA

- Like high returns? → Try AI-powered scalpers such as Quantum Queen MT5

- Want long-term consistency? → Pick trend-following bots like Dominant EA

🏁 Final Thoughts

Choosing the right Forex EA is about aligning it with your trading style, goals, and risk appetite.

Don’t chase hype — focus on verified results, risk control, and long-term stability.

Explore hundreds of tested Forex robots and Forex indicators on forexcrackedvip.com and start automating your trading journey today.

💬 Setup Support: @MY4systemsofficial

🎁 Free Download Zone: ForexCracked VIP Membership

About admin

Best Selling Products

-

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$24.99Current price is: $24.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$19.99Current price is: $19.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$599.00Original price was: $599.00.$0.00Current price is: $0.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,399.00Original price was: $1,399.00.$24.99Current price is: $24.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$55.00Current price is: $55.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,599.00Original price was: $1,599.00.$39.99Current price is: $39.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$2,500.00Original price was: $2,500.00.$19.99Current price is: $19.99.