XM Broker Review 2026: Legit or Scam? The Honest Truth

XM Broker Review 2026: Legit or Scam? The Honest Truth

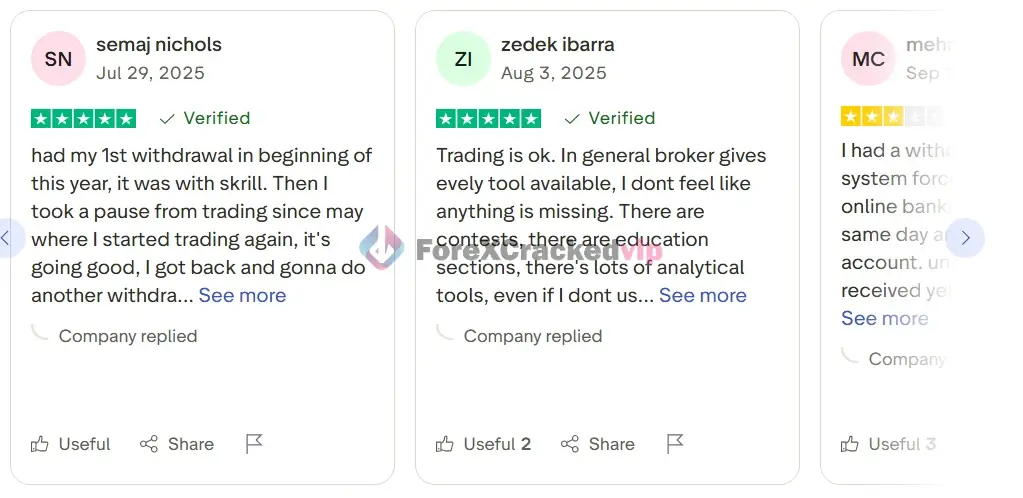

Finding a trustworthy forex broker is harder than learning how to trade. Many brokers look good on the surface but fail when it comes to withdrawals, fair execution, or protecting client funds.

One broker that consistently appears in global trading discussions is XM.

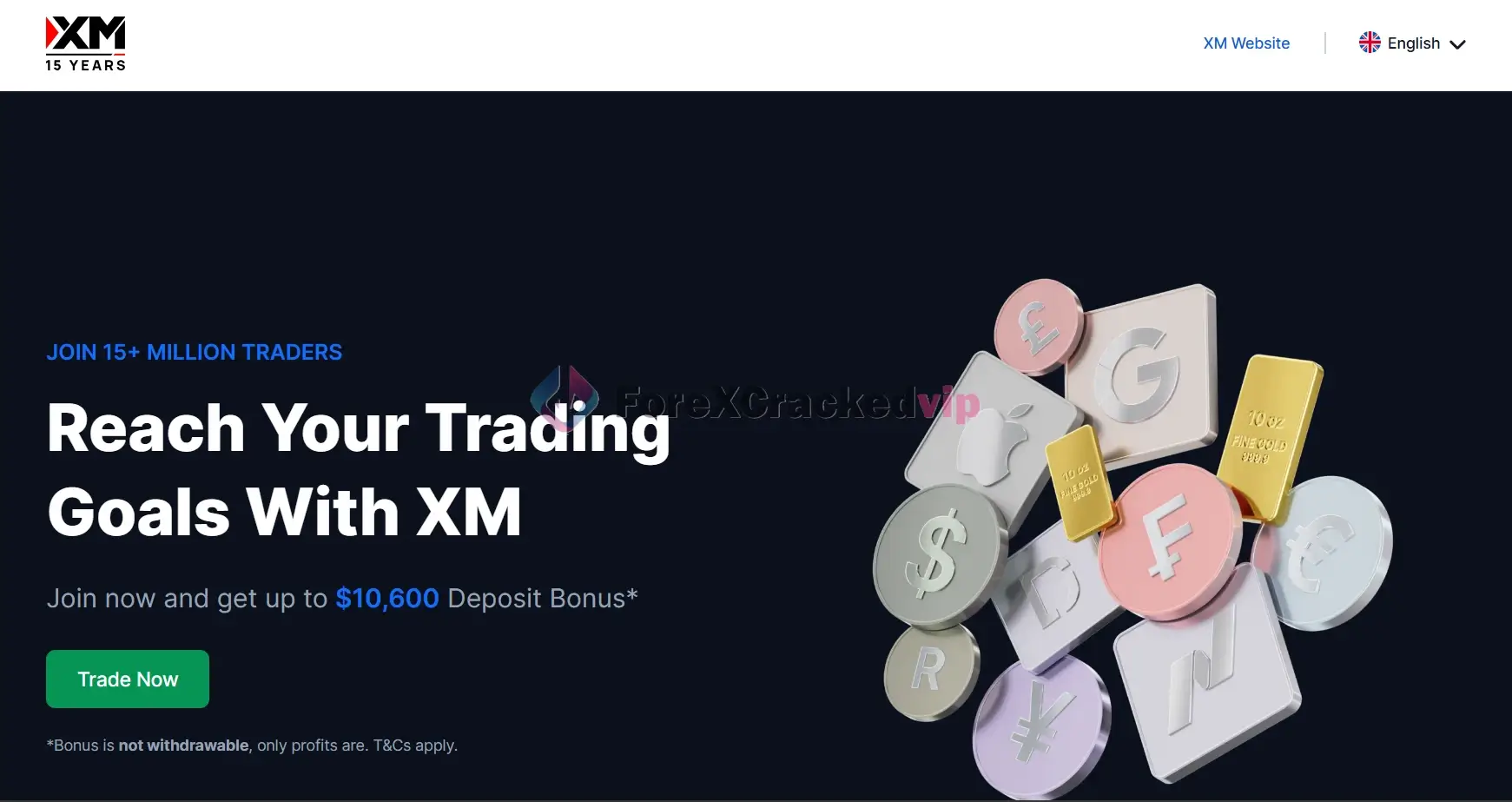

With over 10 million registered clients worldwide, XM markets itself as a fair, beginner-friendly, and highly regulated broker. But marketing claims mean nothing unless they hold up in real trading conditions.

This XM broker review explains everything in simple language, without technical overload, so anyone can clearly understand:

-

Is XM safe?

-

How much does it cost to trade?

-

Can you withdraw your money easily?

-

Is XM actually good for beginners?

📌 Start Earning Profits Today – Free Register Today

📌 More Update & News – Join Telegram Chanel

Quick Verdict: Why Millions of Traders Choose XM

XM is a legitimate, well-regulated broker that focuses on fairness, transparency, and accessibility.

📌 It’s especially popular among beginners, but it also offers strong trading conditions for experienced traders.

The main reasons traders choose XM:

-

Very low minimum deposit (start with just $5)

-

No hidden fees on deposits or withdrawals

-

Fast execution with no requotes

-

Strong global regulation

👉 Start Trading with XM Here

Is XM Safe, Regulation and Fund Protection?

XM is regulated by multiple well-known financial authorities, which means it must follow strict rules about how it operates. therefore, XM is considered very safe.

XM regulatory licenses include:

-

CySEC (Cyprus) – European Union regulation

-

ASIC (Australia) – one of the strictest regulators globally

-

FSC (Belize) – international clients

-

DFSA (Dubai) – Middle East region

What does this mean for you as a trader?

📌 XM provides:

-

Segregated client accounts

Your money is kept separate from the company’s own funds. -

Negative balance protection

You can never lose more than you deposit, even during extreme market moves.

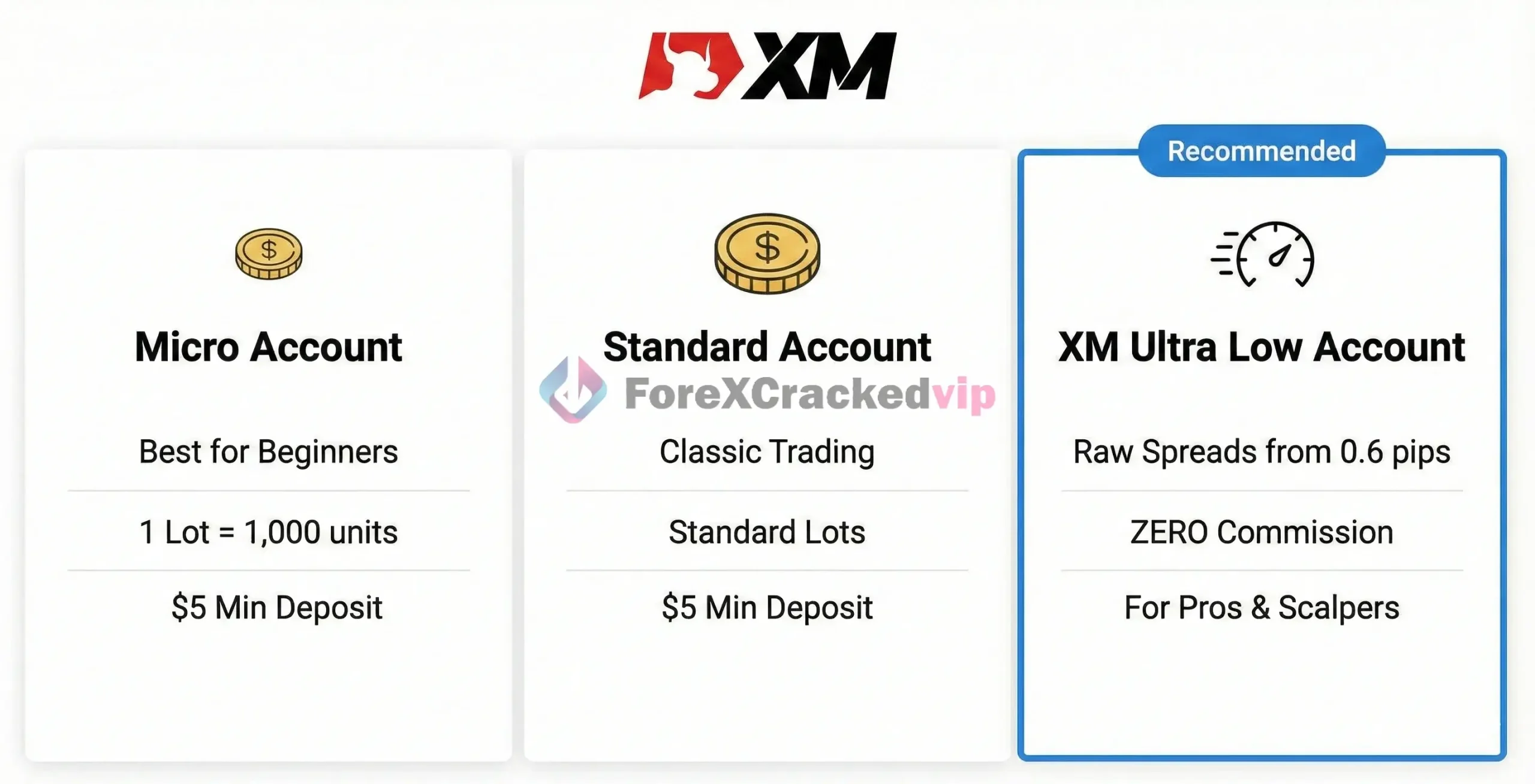

Account Types: Which One Fits You?

XM simplifies the confusion by offering accounts tailored to your experience level. Whether you have $5 or $50,000, there is a setup for you.

1. Micro Account

- Contract Size: 1 Lot = 1,000 units (vs. standard 100,000).

- Benefit: Allows you to manage risk precisely with a small account. Cents move the market, not dollars.

- Minimum Deposit: $5.

2. Standard Account

- Contract Size: Standard Forex lots.

- Benefit: Classic trading conditions for those with traditional strategies.

- Minimum Deposit: $5.

3. XM Ultra Low Account (Highly Recommended)

- Spreads: As low as 0.6 pips.

- Commission: ZERO.

- Benefit: This is XM’s “secret weapon.” It combines raw-spread pricing with zero commissions. If you are a scalper or day trader, this is the account you want.

Trading Conditions: XM’s “No Requotes” Policy

One common beginner frustration is clicking “Buy” and getting a different price than expected.

📌 XM is well known for its No Requotes policy, which means:

-

You trade at the price you see

-

No confirmation pop-ups

-

No price manipulation delays

Execution quality at XM:

-

Over 99% of trades executed in under 1 second

-

Stable execution during normal market conditions

-

Suitable for manual traders and automated strategies

This is why searches like XM execution speed and XM no requotes review are common.

Deposits & Withdrawals: The “Zero Fee” Policy

Nothing is more frustrating than making a profit and losing a chunk of it to withdrawal fees.

XM stands out by covering all transfer fees.

- Deposits: Instant and free.

- Withdrawals: fast processing (usually within 24 hours).

- Methods: Credit/Debit cards, Local Bank Transfers, Neteller, Skrill, and Crypto options.

User Experience Note: In our testing, local bank transfers were processed same-day during business hours, proving their reliability.

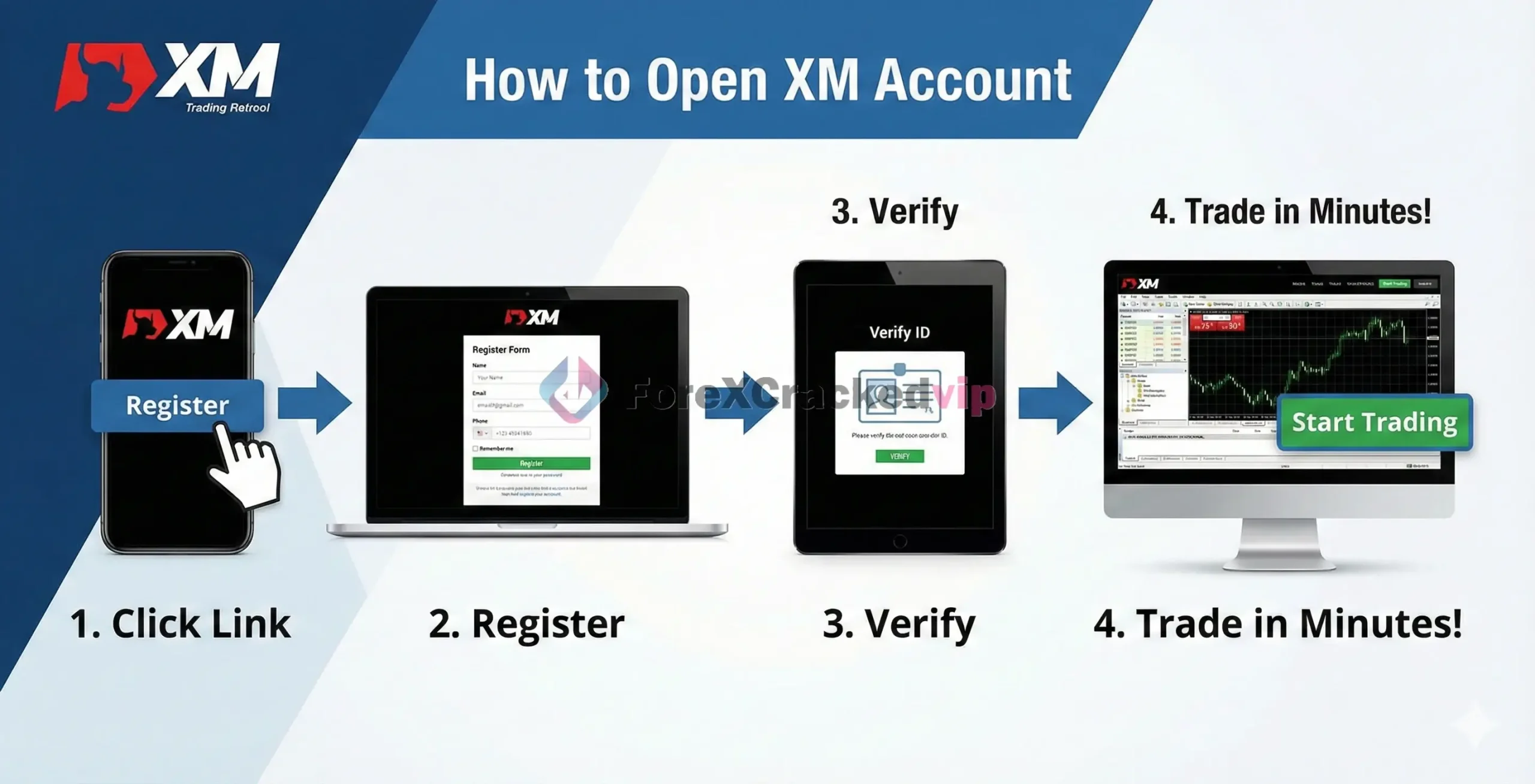

Step-by-Step: How to Open Your Account in 2 Minutes

Ready to test the markets? Opening an account is fully digital and takes less than 2 minutes.

Step 1: Visit the official registration page

👉 Create Your XM Account Here

Step 2: Enter basic details

(Name, email, phone number)

Step 3: Choose platform

Step 4: Select account type

-

Micro → best for beginners

-

Ultra Low → best overall pricing

Step 5: Verify identity and deposit

Upload ID, fund your account (minimum $5), and start trading.

FAQ: Frequently Asked Questions

Q: Is XM a legit broker?

A: Yes. XM is regulated by top-tier authorities like ASIC and CySEC and has been operating since 2009 with a clean track record.

Q: What is the minimum deposit for XM?

A: The minimum deposit is just $5 for Micro and Standard accounts.

Q: Does XM offer a bonus?

A: Yes, XM frequently offers a $30 No Deposit Bonus for new clients (eligible countries only) and Deposit Bonuses up to $5,000 (50% + 20%). Check the link to see what is currently active.

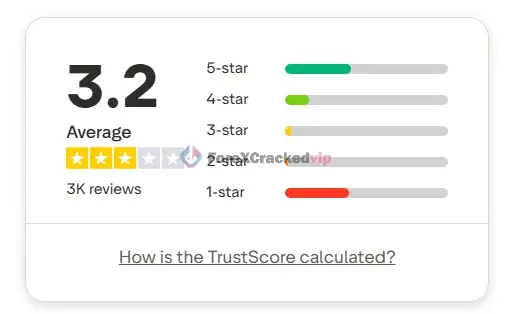

Q: How long do withdrawals take?

A: E-wallet withdrawals are often instant once approved. Bank wires typically take 2–5 business days depending on your bank, but XM processes the request on their end within 24 hours.

Final Thoughts: Who Should Use XM?

XM is not just another broker; it is a safe harbor in a risky industry.

- If you are a beginner: The educational resources, Micro account, and $5 deposit make it the safest place to learn.

- If you are a pro: The Ultra Low account and fast execution, give you the edge you need without paying commissions.

Trading involves risk, but choosing the right broker mitigates the risk of bad service. XM has proven itself for over a decade.

👉 Ready to trade? Create your XM Profile Here

(Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Please ensure you fully understand the risks involved.)

About Isuru Indrajith

Best Selling Products

-

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$599.00Original price was: $599.00.$0.00Current price is: $0.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$24.99Current price is: $24.99. -

Rated 5.00 out of 5 based on 1 customer ratingSale!

Rated 5.00 out of 5 based on 1 customer ratingSale!$999.00Original price was: $999.00.$17.99Current price is: $17.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,599.00Original price was: $1,599.00.$39.99Current price is: $39.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$55.00Current price is: $55.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,399.00Original price was: $1,399.00.$24.99Current price is: $24.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,299.00Original price was: $1,299.00.$55.00Current price is: $55.00.