What Is a Forex EA? Complete Beginner Guide to Expert Advisors (2026)

What Is a Forex EA? Complete Beginner Guide

Retail forex trading has changed dramatically over the last decade. Manual chart watching, emotional decision-making, and late-night trading sessions are being replaced by algorithmic precision. Behind that shift is one powerful tool:

The Forex EA (Expert Advisor).

If you’ve ever wondered:

-

How traders run accounts 24/7 without staring at charts

-

How strategies execute in milliseconds

-

How consistent systems remove emotional mistakes

This guide will give you a complete, advanced-level understanding of what a Forex EA is – and how to use it intelligently.

➡️ Telegram Support: Join for updates, announcements, and support

The Real Problem: Why Most Traders Struggle

Before defining a Forex EA, we must address the core issue in trading.

Most retail traders fail because of:

-

Emotional overtrading

-

Inconsistent strategy execution

-

Poor risk management

-

Revenge trading after losses

-

Inability to stick to rules

Even with a good strategy, humans:

-

Hesitate

-

Override signals

-

Close trades too early

-

Increase lot sizes irrationally

A Forex EA exists to solve exactly that.

What Is a Forex EA? (Advanced Definition)

A Forex EA (Expert Advisor) is an automated trading algorithm designed to execute trades on your behalf within trading platforms like:

It operates based on:

-

Predefined trading logic

-

Technical indicator rules

-

Risk management parameters

-

Market condition filters

Technically, an EA is coded in:

-

MQL4 (for MT4)

-

MQL5 (for MT5)

It continuously monitors:

-

Price action

-

Indicators

-

Spread

-

Time filters

-

Volatility levels

And executes trades automatically when conditions are met.

Core Mechanism: How a Forex EA Actually Works

Let’s break it down into a structured flow:

1️⃣ Market Scanning

The EA constantly scans:

-

Currency pairs

-

Timeframes

-

Indicator values

2️⃣ Condition Matching

It checks if:

-

Moving averages align

-

RSI hits specific zones

-

Breakout levels are triggered

-

Order block or liquidity zones are tapped

3️⃣ Risk Calculation

Before opening a trade, it calculates:

-

Lot size

-

Stop loss

-

Take profit

-

Maximum drawdown limit

4️⃣ Trade Execution

The EA:

-

Opens position instantly

-

Sets protective stops

-

Manages trailing logic

5️⃣ Ongoing Management

Advanced EAs:

-

Adjust stops dynamically

-

Scale into positions

-

Apply recovery logic

-

Close trades partially

This entire process happens in milliseconds – without emotional interference.

Automated Your Trading Using Forex EA

-

6 Best Forex EA collection – 2nd Part | Download Now

-

AGI EA MT4 + SetFile| Download Now

-

AiMaxPro EA MT4 | Download Now

Technical Advantage Analysis

Why do serious traders move toward automation?

✔ Speed

Humans cannot compete with algorithmic execution speed.

✔ Discipline

EAs never:

-

Panic

-

FOMO

-

Revenge trade

✔ 24/5 Operation

With a VPS, EAs trade non-stop.

✔ Backtesting Capability

You can test years of data in minutes using MT4/MT5 Strategy Tester.

Benefits Explained With Scenarios

📌 Scenario 1: The Emotional Scalper

Manual trader:

-

Closes early in fear.

-

Misses full TP.

EA:

-

Executes full strategy.

-

Locks exact RR ratio.

📌 Scenario 2: The Busy Professional

Manual trader:

-

Cannot monitor London session.

EA:

-

Executes strategy automatically during key sessions.

Real-World Application Example

Let’s say you install a Gold trading EA.

You configure:

-

Risk: 2% per trade

-

Max 3 trades per day

-

ATR-based stop loss

-

Trailing profit activation

Instead of overtrading, the system:

-

Waits for high-probability setups

-

Executes with strict rules

-

Stops trading after reaching daily cap

This transforms trading into a structured system.

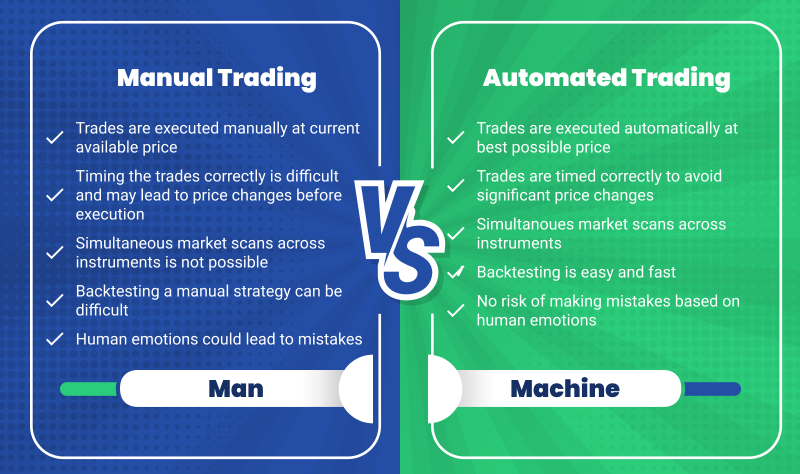

Forex EA vs Manual Trading

| Factor | Manual Trading | Forex EA |

|---|---|---|

| Emotion | High | Zero |

| Speed | Slow | Instant |

| Consistency | Variable | Fixed |

| Monitoring | Required | Automated |

| Scalability | Limited | High |

However – automation does not remove risk.

Risk & Limitation Analysis

A Forex EA is not a money-printing machine.

Major risks include:

⚠ Over-Optimized Backtests

Curve fitting can produce unrealistic historical performance.

⚠ Broker Conditions

High spread or slippage can destroy scalping EAs.

⚠ Aggressive Recovery Systems

Grid & martingale strategies can:

-

Blow accounts during strong trends.

⚠ Market Regime Change

Strategies built for trending markets may fail in ranging markets.

This is why selection and testing matter.

Who Should Use a Forex EA?

✔ Beginner Traders

-

To avoid emotional mistakes

-

To learn structured trading

✔ Intermediate Traders

-

To scale capital

-

To automate proven strategies

✔ Portfolio Traders

-

To diversify multiple systems

-

To run different logics across pairs

❌ Not Ideal For

-

Traders seeking “guaranteed profit”

-

Those unwilling to monitor performance monthly

Common Strategic Mistakes

Avoid these:

-

Installing without backtesting

-

Using default aggressive settings

-

Ignoring VPS stability

-

Running high-risk martingale on small accounts

-

Not understanding strategy logic

Advanced Optimization Tips

If you want professional-level deployment:

1️⃣ Use a VPS

Ensures:

-

24/5 uptime

-

Low latency

-

Stable execution

2️⃣ Test Across Brokers

Compare:

-

Spread

-

Execution speed

-

Slippage

3️⃣ Run on Demo First

Minimum:

-

2-4 weeks forward testing

4️⃣ Diversify Systems

Instead of 1 EA:

-

Use 2-3 uncorrelated systems

People Also Ask

1. Are Forex EAs legal?

Yes. They are fully supported inside MetaTrader platforms.

2. Can a Forex EA guarantee profit?

No system can guarantee profits. Risk always exists.

3. Do professional traders use EAs?

Many institutional traders use algorithmic trading systems.

4. Can beginners use Forex EAs?

Yes – if they understand risk management.

5. Do I need coding knowledge?

No. Installation is simple.

Frequently Asked Questions (FAQ)

1. What is the difference between MT4 and MT5 EAs?

MT4 uses MQL4; MT5 uses MQL5 and supports more advanced multi-thread backtesting.

2. Can I run multiple EAs at once?

Yes, on different charts or symbols.

3. What timeframe is best for EAs?

Depends on strategy – scalping (M1–M15), swing (H1–H4).

4. Do EAs work on all currency pairs?

Not always. Some are optimized for specific pairs.

5. How much capital is required?

Depends on risk settings. Conservative traders start with $500–$1000.

Final Strategic Verdict

A Forex EA is not magic.

It is a tool.

Used correctly, it provides:

-

Discipline

-

Scalability

-

Systematic execution

-

Portfolio diversification

Used blindly, it can destroy capital.

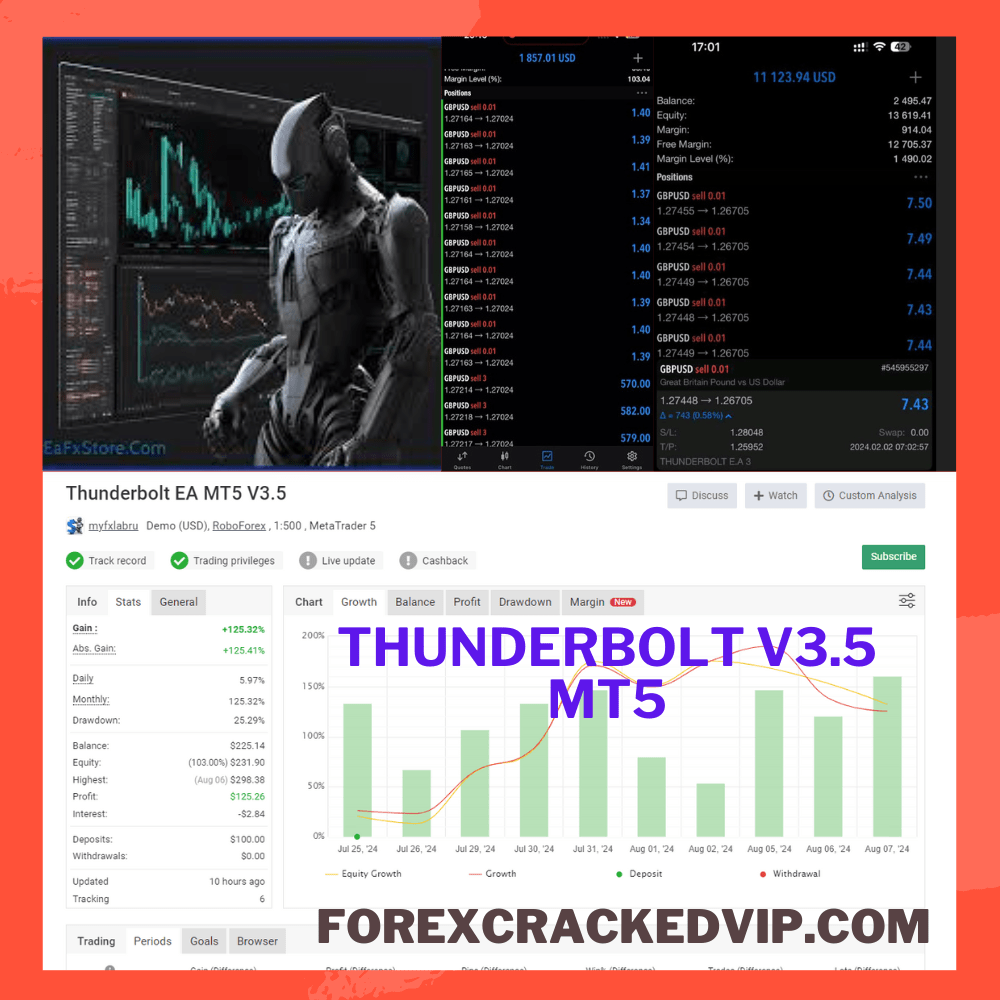

If you want to explore high-quality, tested systems and stay updated with the latest automation strategies:

🔹 Visit: https://forexcrackedvip.com/product-category/forex-ea/

🔹 Join our Telegram community for exclusive updates and discussions

Trade smart. Automate intelligently. Scale strategically.

About William S

Best Selling Products

-

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$599.00Original price was: $599.00.$0.00Current price is: $0.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$24.99Current price is: $24.99. -

Rated 5.00 out of 5 based on 1 customer ratingSale!

Rated 5.00 out of 5 based on 1 customer ratingSale!$999.00Original price was: $999.00.$17.99Current price is: $17.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,599.00Original price was: $1,599.00.$39.99Current price is: $39.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$55.00Current price is: $55.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,399.00Original price was: $1,399.00.$24.99Current price is: $24.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$19.99Current price is: $19.99.