Pros and Cons of Automated Forex Trading: A Complete Guide 2026

Pros and Cons of Automated Forex Trading

Automated forex trading, often powered by expert advisors (EAs) and trading robots, has become a popular approach for both novice and experienced traders. By relying on algorithms rather than human emotions, it promises efficiency, speed, and potentially higher profits. But is it truly the ideal solution for everyone? In this guide, we’ll explore the pros and cons of automated forex trading, helping you decide whether it fits your trading style and goals.

➡️ Telegram Support: Join for updates, announcements, and support

What is Automated Forex Trading?

Automated forex trading, also called algorithmic trading or EA trading, involves using software programs to execute trades based on predefined rules. These programs analyze market data, identify trading opportunities, and execute buy or sell orders automatically. Popular platforms like MT4 and MT5 support these robots, making it easier than ever for traders to automate their strategies.

How Does Automated Forex Trading Work?

-

Strategy Definition: Traders set rules for entry, exit, stop-loss, and take-profit levels.

-

Algorithm Programming: These rules are programmed into a trading robot (EA).

-

Market Analysis: The robot continuously monitors forex markets for patterns and signals.

-

Trade Execution: Trades are executed automatically, 24/7, according to the programmed rules.

-

Reporting and Optimization: Traders review results and fine-tune the strategy to maximize performance.

Mini Project Example: You could create a simple EMA crossover EA on MT4 to trade EUR/USD automatically based on two moving averages. The robot will buy when the fast EMA crosses above the slow EMA and sell when it crosses below.

Pros of Automated Forex Trading

1. Emotion-Free Trading

One of the biggest advantages of using trading robots is the removal of human emotions. Fear and greed often lead to mistakes, but an EA strictly follows the rules.

2. Backtesting Capabilities

Automated systems allow you to backtest strategies on historical data to understand potential outcomes before risking real money.

3. Increased Trading Speed

EAs can analyze multiple markets simultaneously and execute trades instantly, something impossible for human traders.

4. 24/7 Market Monitoring

Forex markets never sleep, and automated trading ensures that you never miss trading opportunities, even while you’re asleep.

5. Consistency and Discipline

Robots follow strategies consistently without deviation, ensuring disciplined trading regardless of market volatility.

6. Multi-Strategy Implementation

You can run multiple strategies or EAs at the same time across different currency pairs to diversify your approach and spread risk.

Cons of Automated Forex Trading

1. Technical Failures

Automated trading depends on technology. Internet outages, platform crashes, or hardware issues can lead to missed opportunities or unexpected losses.

2. Over-Optimization Risk

Some traders fall into “curve-fitting” traps, over-optimizing strategies for historical data. While past performance looks perfect, real market conditions can yield poor results.

3. Lack of Human Judgment

Market anomalies, news events, or sudden volatility can affect trades in ways a robot cannot adapt to unless pre-programmed.

4. Initial Costs

High-quality EAs can be expensive. Some may also require VPS (Virtual Private Server) hosting to run 24/7, adding additional costs.

5. False Sense of Security

Automated systems may give traders confidence to risk larger amounts than advisable. Remember, no robot guarantees profits.

People Also Ask – Questions Answered

1. What are the advantages of using forex robots?

Forex robots remove emotions, allow backtesting, trade multiple pairs simultaneously, and operate 24/7, making them ideal for disciplined and consistent trading.

2. Can automated trading guarantee profits?

No. While EAs can improve efficiency and reduce emotional errors, market risks still exist, and no automated system can guarantee profits.

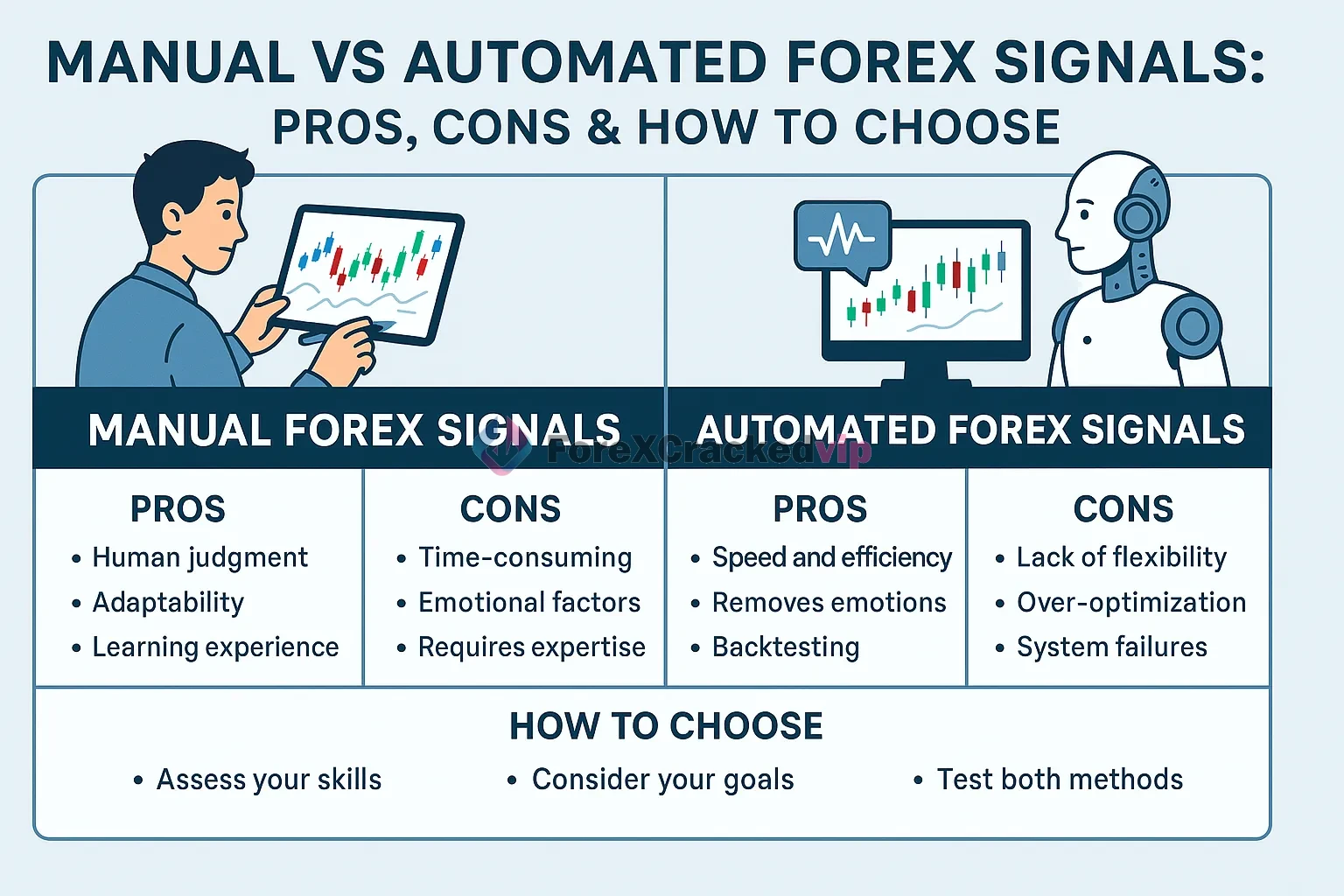

3. Is automated forex trading better than manual trading?

It depends on the trader. Beginners may benefit from automation for consistency, while experienced traders might prefer manual trading for flexibility and discretion.

4. Do I need programming skills to use automated trading?

Not necessarily. Many EAs are ready-to-use with platforms like MT4 or MT5, although basic customization may require coding knowledge.

5. How much does automated forex trading cost?

Costs vary. Some EAs are free, while premium options range from $50 to several hundred dollars. Additional costs include VPS hosting and broker fees.

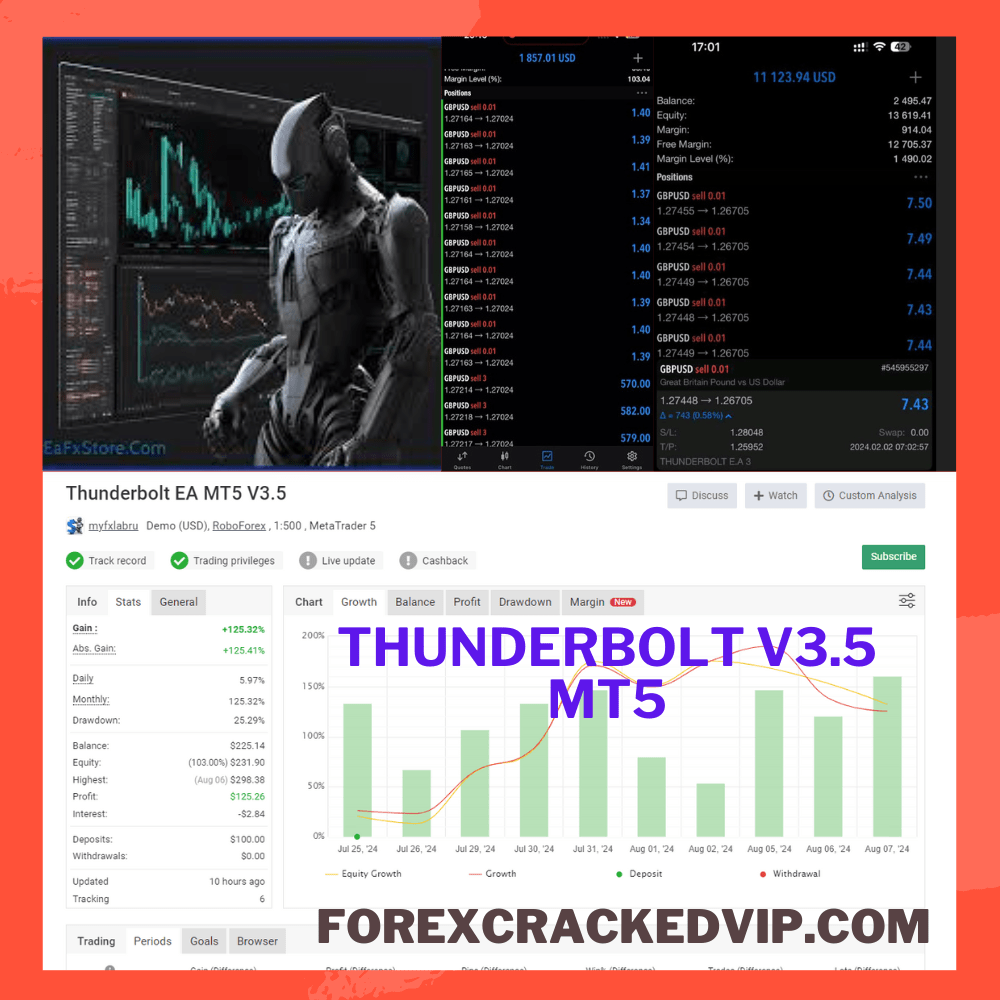

Internal Project Example: Optimizing EA Performance on MT4

On our platform, we experimented with a grid trading EA for EUR/USD. By adjusting the take-profit and stop-loss levels and running backtests on MT4, we achieved a 15% increase in historical strategy efficiency. Using internal analytics, traders can customize EAs for specific market conditions and improve long-term results.

Best Practices for Automated Forex Trading

-

Start Small: Test with demo accounts before using real money.

-

Diversify Strategies: Use multiple EAs to reduce risk.

-

Regularly Monitor: Even automated systems need oversight.

-

Stay Updated: Market conditions change, and strategies must adapt.

-

Use a Reliable VPS: Ensures your robot runs uninterrupted 24/7.

——————————————————————————————–

-

VIGRO PRO V5 EA MT4 – Advanced XAUUSD Gold Scalping Expert Advisor | Download Now

-

BTX Scalper Pro EA MT5 – Advanced Trend-Flow Scalping System | Download Now

-

Evara MT5 EA – Advanced AI-Driven Expert Advisor for MetaTrader 5 | Download Now

——————————————————————————————–

-

How Forex Robots Work in MT4 & MT5 (Complete Technical Guide) | Read First

-

What Is a Forex EA? Complete Beginner Guide to Expert Advisors | Read First

——————————————————————————————–

You can download the EA instantly from our website.

Want unlimited access to 500+ premium Forex robots?

👉 Become a VIP Member:

🔗 https://forexcrackedvip.com/memberships/

VIP Members get:

- Unlimited EA downloads

- Premium indicators

- Lifetime access

- Weekly updates

- Priority support

Ready to streamline your forex trading and reduce emotional mistakes? Explore our collection of high-performing EAs on Forex Cracked VIP and start testing automated strategies with confidence. Maximize efficiency, consistency, and your potential profits with the right tools today!

Frequently Asked Questions (FAQ)

1. What is automated forex trading?

Automated forex trading uses software programs, called EAs, to execute trades automatically based on pre-set rules, eliminating manual intervention.

2. Are forex robots profitable?

They can be profitable but are not guaranteed. Success depends on the strategy, market conditions, and proper risk management.

3. Can I trade forex automatically without experience?

Yes, beginners can use pre-built EAs, but understanding trading basics helps optimize performance and manage risks.

4. Do I need a VPS for automated trading?

A VPS is recommended for uninterrupted 24/7 trading, especially if your EA runs continuously and requires low latency.

5. How do I choose the best EA for me?

Look for verified performance, backtesting results, strategy type, and reviews. Test on demo accounts before using real funds.

About William S

Best Selling Products

-

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$599.00Original price was: $599.00.$0.00Current price is: $0.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$24.99Current price is: $24.99. -

Rated 5.00 out of 5 based on 1 customer ratingSale!

Rated 5.00 out of 5 based on 1 customer ratingSale!$999.00Original price was: $999.00.$17.99Current price is: $17.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,599.00Original price was: $1,599.00.$39.99Current price is: $39.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$55.00Current price is: $55.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,399.00Original price was: $1,399.00.$24.99Current price is: $24.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$19.99Current price is: $19.99.