Master the Martingale Strategy: A Path to Recovery in 2025 | Full Forex Review

Posted by

Looking to recover from trading losses in Forex and boost your profits? The Martingale strategy might be your answer — a powerful (yet risky) method that turns market reversals into profit opportunities. In this 2025 complete review, we’ll break down how the Martingale strategy works, when to use it, key risks, and how to protect your capital using smart tools like cent accounts and technical indicators.

What You’ll Learn in This Review:

- ✅ What is the Martingale strategy in Forex?

- ⚙️ How Martingale works in real trading

- 📈 When to apply the strategy (and when not to)

- 🧠 Logic & psychology behind Martingale

- 📊 Best indicators to use with Martingale

- 💸 Account size, leverage, and capital tips

- 🏦 Cent account advantages

- 📉 Risks and outcomes explained

- ✅ Expert conclusion with risk advice

Let’s dive in.

1. What is the Martingale Strategy?

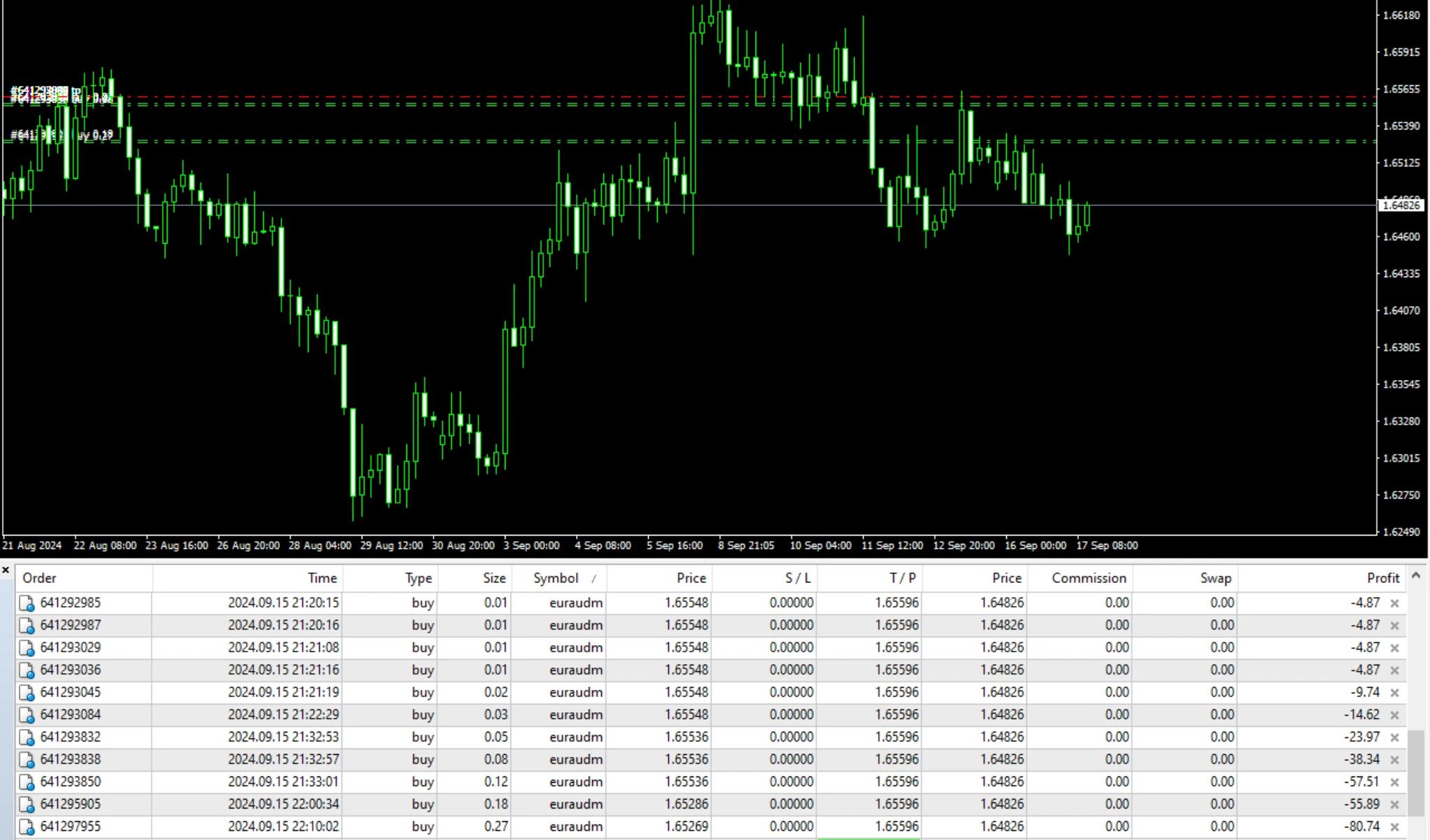

The Martingale strategy is a Forex trading method where traders double their position size every time a trade goes against them. The goal is to recover all previous losses with one successful reversal.

It’s based on the assumption that market prices will eventually retrace — allowing you to close all trades in profit or at break-even.

How Does the Martingale Strategy Work?

Here’s how it plays out:

- You place an initial trade.

- If it goes into loss, you open a new trade in the same direction, but with a larger lot size.

- When the market reverses, the larger trade wins enough pips to cover all previous losses.

Example:

- Trade 1: Sell EUR/USD at 1.1000 → Price rises to 1.1050 = loss

- Trade 2: Sell again at 1.1050 with larger lot → Target 1.1000

- If price drops to 1.1000 → Trade 1 = breakeven, Trade 2 = profit ✅

When Can the Strategy Be Applied?

Ideal Conditions for Martingale:

- 🔄 Ranging or sideways markets

- ⏸️ Markets with temporary volatility (not long-term trends)

- 🔍 News-related spikes that usually reverse

Avoid Using Martingale When:

- 📈 Market is in a strong trend (uptrend/downtrend)

- 📰 News creates long-lasting impact (like interest rate hikes)

- 🛑 There’s no clear support/resistance zone

2. The Logic Behind the Martingale Strategy

The Martingale strategy assumes markets don’t move in one direction forever.

Even in a trend, prices make corrections or pullbacks. This gives the trader a chance to recover losses and exit profitably.

“Every trend has a correction. Martingale leverages that correction.”

What is the Core Idea of the Strategy?

- Market volatility is natural.

- No pair moves in a straight line forever.

- Martingale uses price retracements to recover from drawdowns.

For example, if EUR/USD moves 50–100 pips daily, and you’re trading based on this range, you can anticipate a likely retracement during the week.

With each drop, you enter bigger trades expecting a rebound — and one profitable trade can wipe out previous losses.

Useful Indicators with Martingale

To reduce risks and improve accuracy, pair Martingale with technical indicators.

Recommended Tools:

- RSI (Relative Strength Index):

- RSI > 70 = Overbought → Possible sell signal

- RSI < 30 = Oversold → Possible buy signal

- Bollinger Bands: Identify extreme price points.

- MACD / Stochastic Oscillator: Confirm momentum shifts.

These tools help time your entries, so you’re not blindly doubling positions.

3. Possible Outcomes of the Martingale Strategy

Like any Forex system, Martingale has both rewards and risks:

Pros:

- Can recover from large losses

- Small retracement = big profit

- Great in range markets

Cons:

- High risk of margin call

- Not suitable for trending pairs

- Emotionally stressful if not managed

Account Size & Capital Requirements

There’s no fixed balance, but your account must support:

- Increasing lot sizes

- Floating drawdowns

- Margin requirements

Example:

Start with 0.01 lot → After 10 steps, you could be trading 10.24 lots total.

Can your account handle that?

Use a Cent Account to Reduce Risk

The best way to use Martingale for beginners is with a cent account.

How It Works:

- Deposit $100 → Account shows $10,000 (in cents)

- You can test the Martingale strategy with real market data but low financial risk

- Ideal for practicing without blowing your capital

Types of Accounts:

| Account Type | Lot Size | Best For |

|---|---|---|

| Cent | 0.01 | Low-risk testing |

| Micro | 0.10 | Intermediate traders |

| Standard | 1.00 | High-capital traders |

Final Conclusion: Should You Use the Martingale Strategy in 2025?

The Martingale strategy remains one of the most powerful yet risky Forex recovery tools in 2025. It’s best used by traders who:

✅ Understand price action

✅ Have strong risk management

✅ Use technical indicators

✅ Trade in range or sideways markets

✅ Accept the possibility of a complete loss

Have Questions or Want to Learn More?

Drop your thoughts in the comments or check out our guides on:

- How to Use RSI for Entry Timing

- Top 5 Risk Management Tools in Forex

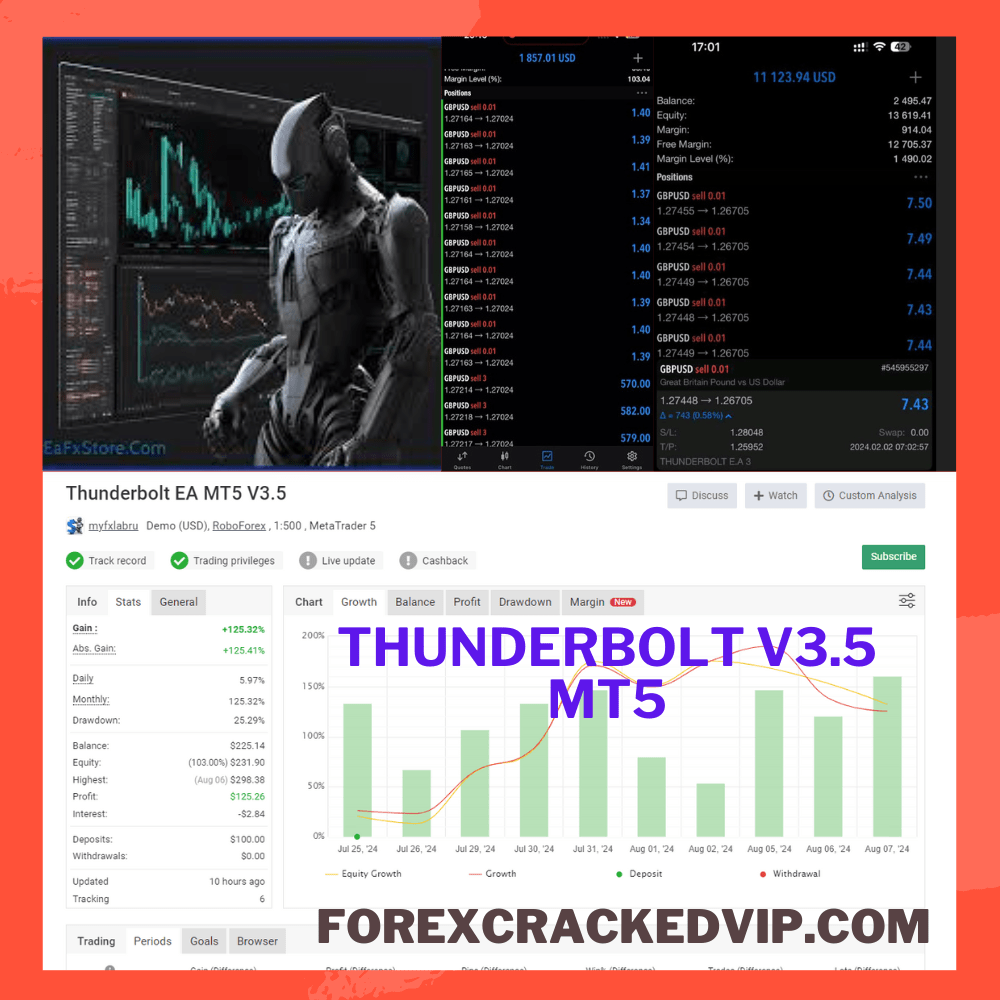

- Martingale EA (Expert Advisor) Guide

📲 Join the Official Telegram

Best Selling Products

-

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$599.00Original price was: $599.00.$0.00Current price is: $0.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$24.99Current price is: $24.99. -

Rated 5.00 out of 5 based on 1 customer ratingSale!

Rated 5.00 out of 5 based on 1 customer ratingSale!$999.00Original price was: $999.00.$17.99Current price is: $17.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,599.00Original price was: $1,599.00.$39.99Current price is: $39.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$55.00Current price is: $55.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,399.00Original price was: $1,399.00.$24.99Current price is: $24.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$19.99Current price is: $19.99.