JustMarkets Review 2026: A Trader’s Honest Verdict on Spreads, Speed, and Safety

JustMarkets Review 2026: An Honest, Beginner-Friendly Look at Safety, Spreads, and Withdrawals

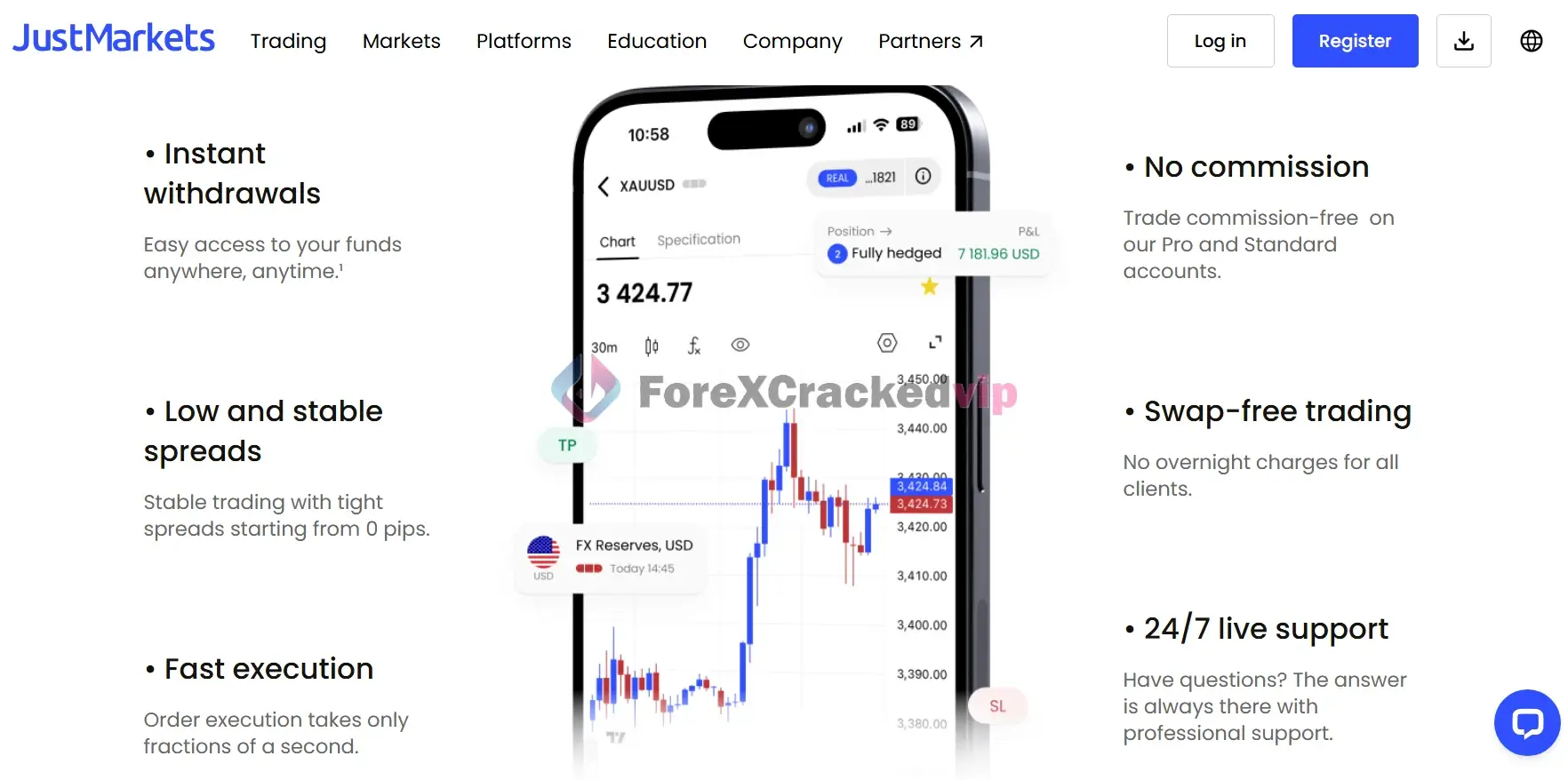

If you’re new to forex trading, choosing a broker can feel overwhelming. Every website promises “tight spreads,” “fast execution,” and “zero risk,” but very few explain what those things actually mean or whether you can trust them with your money.

One broker that keeps popping up in 2026 trading discussions is JustMarkets. Some traders swear by it. Others ask the obvious question:

Is JustMarkets legit, or is it just another over-marketed broker?

This review answers that question in plain language. No hype. No technical overload. Just the facts explained so even a complete beginner can understand what they’re signing up for.

📌 Start Earning Profits Today – Free Register Today

📌 More Update & News – Join Telegram Chanel

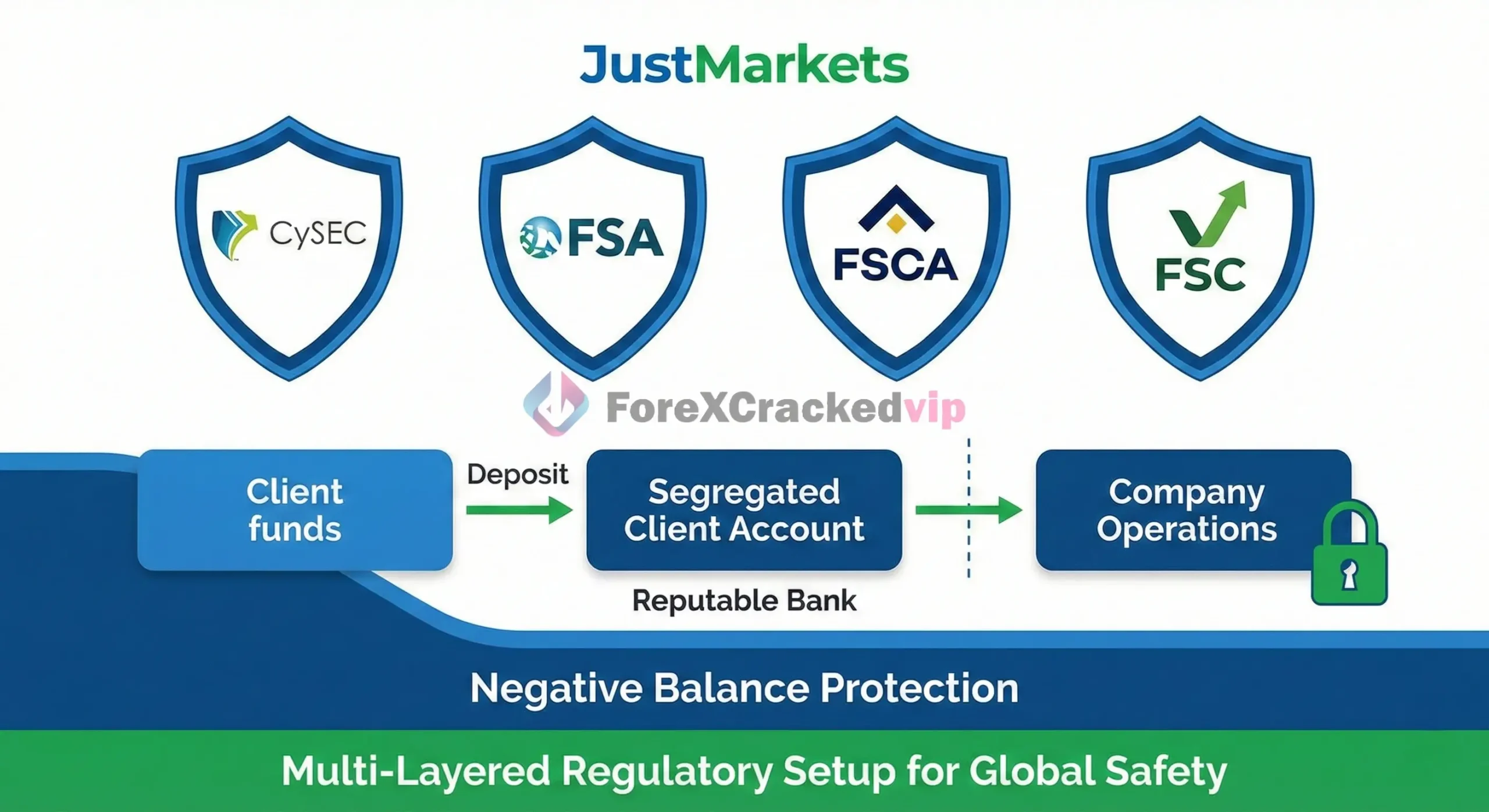

Is JustMarkets Regulated and Safe?

Before thinking about profits, leverage, or bonuses, one thing matters more than anything else:

📌 So, is JustMarkets regulated?

Yes, JustMarkets is a regulated broker, but like most global brokers, it operates under multiple licenses depending on your country.

Here’s what that means in simple terms:

-

CySEC (Cyprus – EU regulation)

This is a strong European regulator. If you’re in the EU, this offers higher protection, including investor compensation (up to €20,000). -

FSA (Seychelles – License SD088)

This is the international license used for most global clients. It allows higher leverage (up to 1:3000) and flexible trading conditions. -

FSCA (South Africa) & FSC (Mauritius)

These licenses ensure legal compliance in African and Asian regions.

📌 What actually protects you as a trader?

JustMarkets uses:

-

Segregated client accounts (your money is kept separate from the company’s funds)

-

Negative balance protection (you can’t lose more than you deposit)

That combination doesn’t guarantee profits, no broker can, but it does reduce the risk of broker-side disasters.

Bottom line:

JustMarkets is not a scam. It’s a properly licensed broker operating legally across multiple regions.

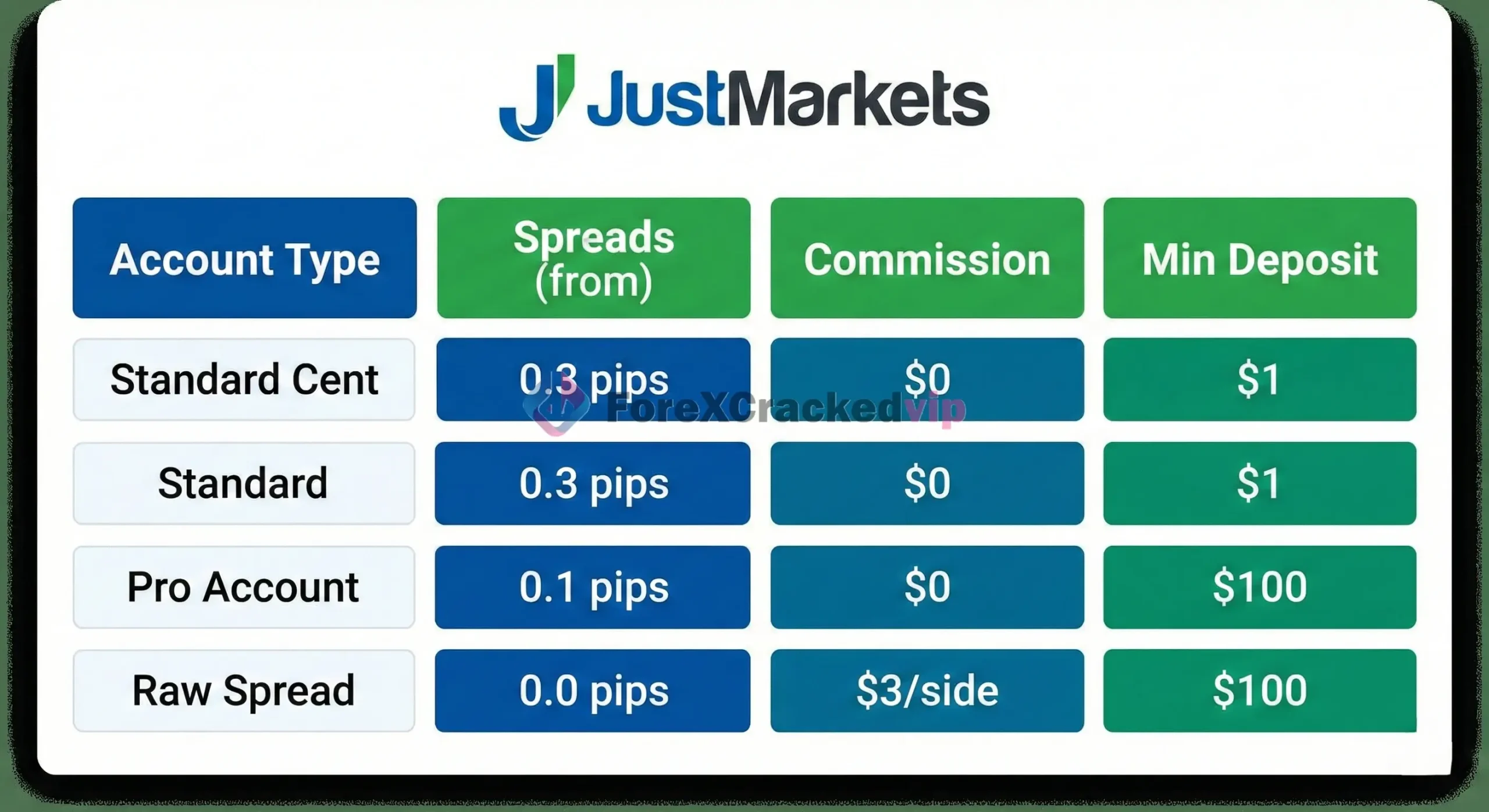

Which JustMarkets Account Type Should You Choose?

One of the biggest beginner mistakes is choosing the wrong account type and bleeding money through spreads and fees.

JustMarkets offers several account types, but you don’t need all of them.

👉 Here’s the simple breakdown:

👉 Beginner advice:

If you’re new, start with Cent or Standard. Move to Pro only when you understand spreads and risk management.

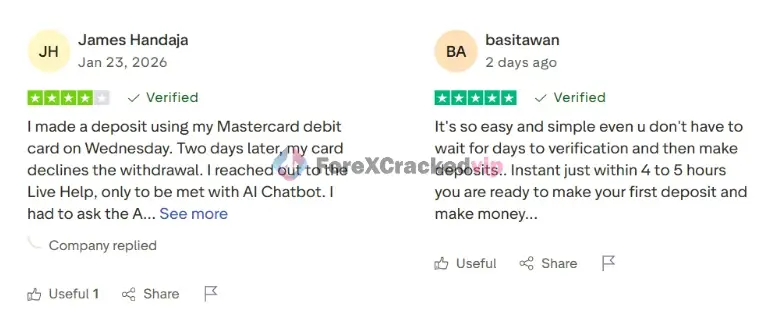

JustMarkets Withdrawal Reviews

This is where many brokers fail and where traders lose trust fast.

📌 So, how are JustMarkets withdrawals in 2026?

Based on real user reviews and testing, withdrawals are reliable as long as you follow the rules.

📌 Fastest Withdrawal Methods (Ranked)

1. E-Wallets (Skrill, Neteller, Perfect Money)

-

Speed: Instant to 1 hour

-

Best choice if you want same-day withdrawals

2. Cryptocurrency (USDT, BTC)

-

Speed: 30 minutes to 2 hours

-

Depends on blockchain traffic

3. Local Bank Transfer

-

Speed: 4 to 24 hours

-

Very popular in India, Indonesia, Kenya, and Malaysia

4. Cards (Visa / Mastercard)

-

Speed: 3-5 business days

-

Slow due to banks, not JustMarkets

📌 Minimum withdrawal?

Usually $5-$10, depending on the method. That’s beginner-friendly and realistic.

How to Open Your JustMarkets Account (Step-by-Step)

If you’re ready to get started, the JustMarkets registration process is one of the smoothest I’ve seen, usually taking less than 5 minutes to set up. Follow these exact steps to ensure you use our partner link for maximum bonus eligibility:

-

Step 1: Visit the Official Portal Click here to go to the JustMarkets Official Registration Page. Using this link automatically tags your account for the $30 No Deposit Bonus.

-

Step 2: Basic Registration Enter your email, create a strong password, and select your country of residence. Ensure the information matches your legal documents.

-

Step 3: Quick Email Verification Check your inbox for a 6-digit verification code. Enter it on the site immediately to activate your access.

-

Step 4: Complete Your Profile Log in to your JustMarkets client area and provide your basic details, including your full name, date of birth, and physical address.

-

Step 5: Identity Verification (KYC) Upload a clear photo of your National ID or Passport and a utility bill for address proof. Verification is typically completed within the same day.

Note: Completing this step early is the best way to prevent any JustMarkets withdrawal issues later.

-

Step 6: Configure Your Trading Platform Inside the dashboard, click “Open New Account.” Choose between JustMarkets MT4 or MT5, and select your preferred account type (e.g., the Pro or Raw Spread account).

-

Step 7: Fund and Trade Navigate to the “Deposit” section. Choose from local bank transfers, crypto, or e-wallets. You can start with as little as $1, though $100 is recommended to fully utilize the Pro features.

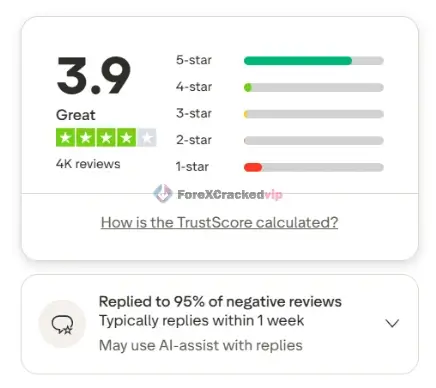

The 1:3000 Leverage: A Double-Edged Sword

JustMarkets is famous for offering leverage up to 1:3000. For a trader with a small deposit, this means you can control larger positions with very little margin.

Example: If EUR/USD is 1.1000, the margin for a 0.01 lot at 1:3000 is less than $1. However, always remember the “leverage paradox” while it allows for huge gains, it can wipe an account instantly if you don’t use a stop-loss.

However, always remember the “leverage paradox” while it allows for huge gains, it can wipe an account just as fast if you don’t use a stop-loss.

Real Feedback: Addressing Complaints & Reddit Rumors

No broker has perfect reviews. JustMarkets is no exception.

📌 Common complaints you’ll see online:

-

“My withdrawal is pending”

-

“Slippage during news events”

📌 What’s actually happening?

-

Most withdrawal delays happen because:

-

KYC not completed

-

Trying to withdraw to a different method than the deposit

-

This triggers anti-money laundering checks, not scams.

Slippage during high-impact news (like NFP) happens with every broker, especially during extreme volatility.

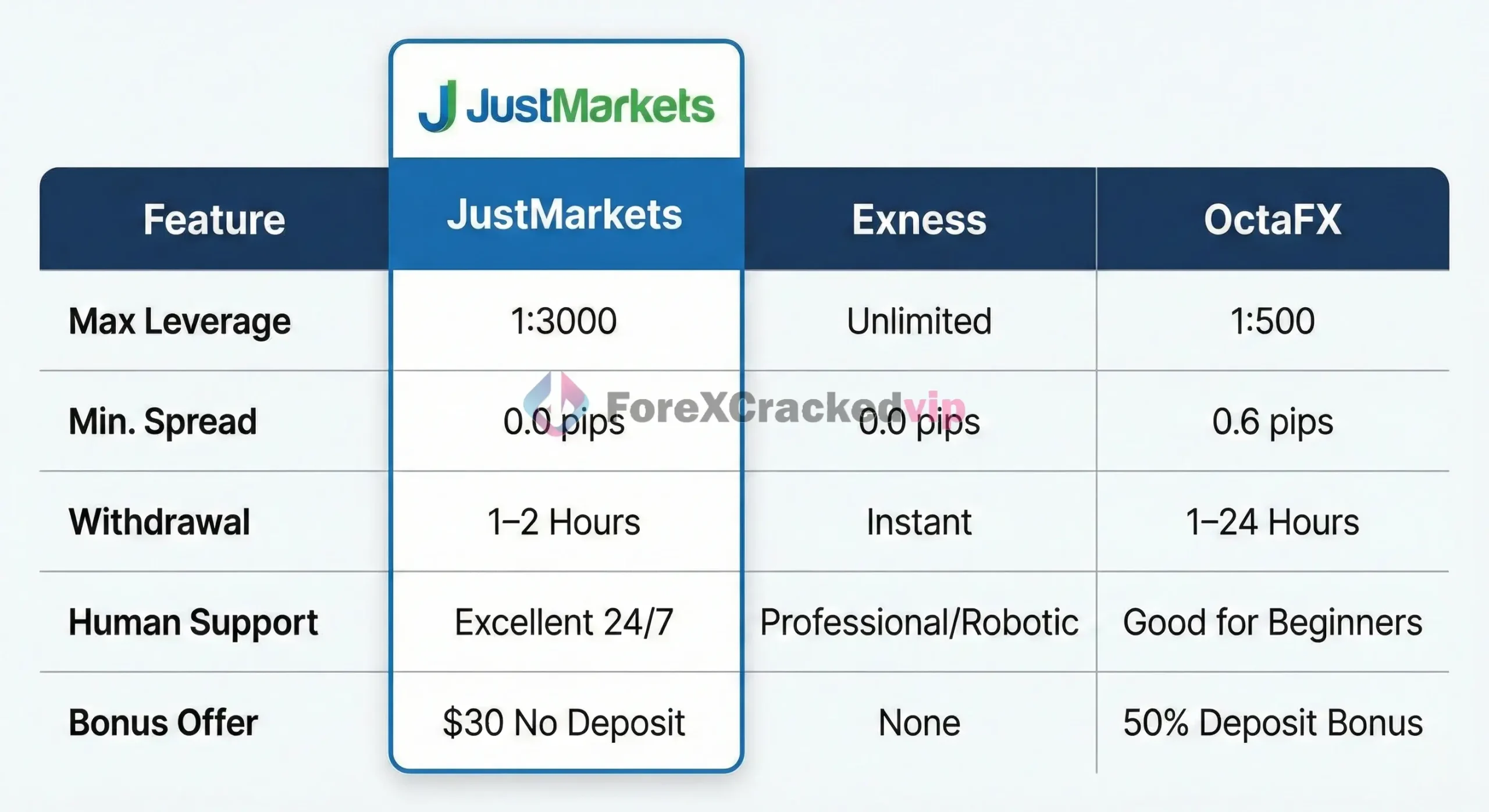

Comparison: JustMarkets vs. Exness vs. OctaFX

Quick comparison for beginners:

-

JustMarkets → Flexible, high leverage, bonuses, beginner-friendly

-

Exness → Ultra-fast withdrawals, more technical, less promotional

-

OctaFX → Clean interface, fewer advanced options

Verdict:

If you’re a beginner or small retail trader, JustMarkets offers more flexibility and incentives.

Frequently Asked Questions (FAQ)

Q: Is JustMarkets a scam?

A: No. JustMarkets has been in operation since 2012, serves 3 million+ traders, and holds multiple regulatory licenses. They won “Best Global Broker of the Year” in 2025.

Q: Can I use MetaTrader 4 on JustMarkets? A: Yes! They offer both JustMarkets MT4 and MT5. They even launched a new “JustMarkets-Live2” server to handle high-frequency trading without lag.

Q: How do I get the $30 No Deposit Bonus?

A: You must be a new client. Register through this JustMarkets link, complete your KYC verification, and open a “Welcome Account” in the promotions section.

Q: What is the minimum deposit?

A: You can start with as little as $1 for Cent/Standard accounts, though $10 is recommended for better risk management.

Q: Does JustMarkets offer an Islamic account?

A: Yes, they provide swap-free trading for all clients by default, which is perfect for those following Sharia principles.

Final Thoughts: Should You Sign Up?

JustMarkets isn’t perfect, no broker is.

But in 2026, it stands out for one reason:

It makes trading accessible without cutting corners on safety.

Low deposits, multiple withdrawal methods, strong regulation, and flexible account types make it a solid choice for beginners and intermediate traders alike.

👉 If you’re ready to start trading, open your JustMarkets account here and access current bonuses

Trade smart. Manage risk. And never trust a broker or a review that promises guaranteed profits.

About Isuru Indrajith

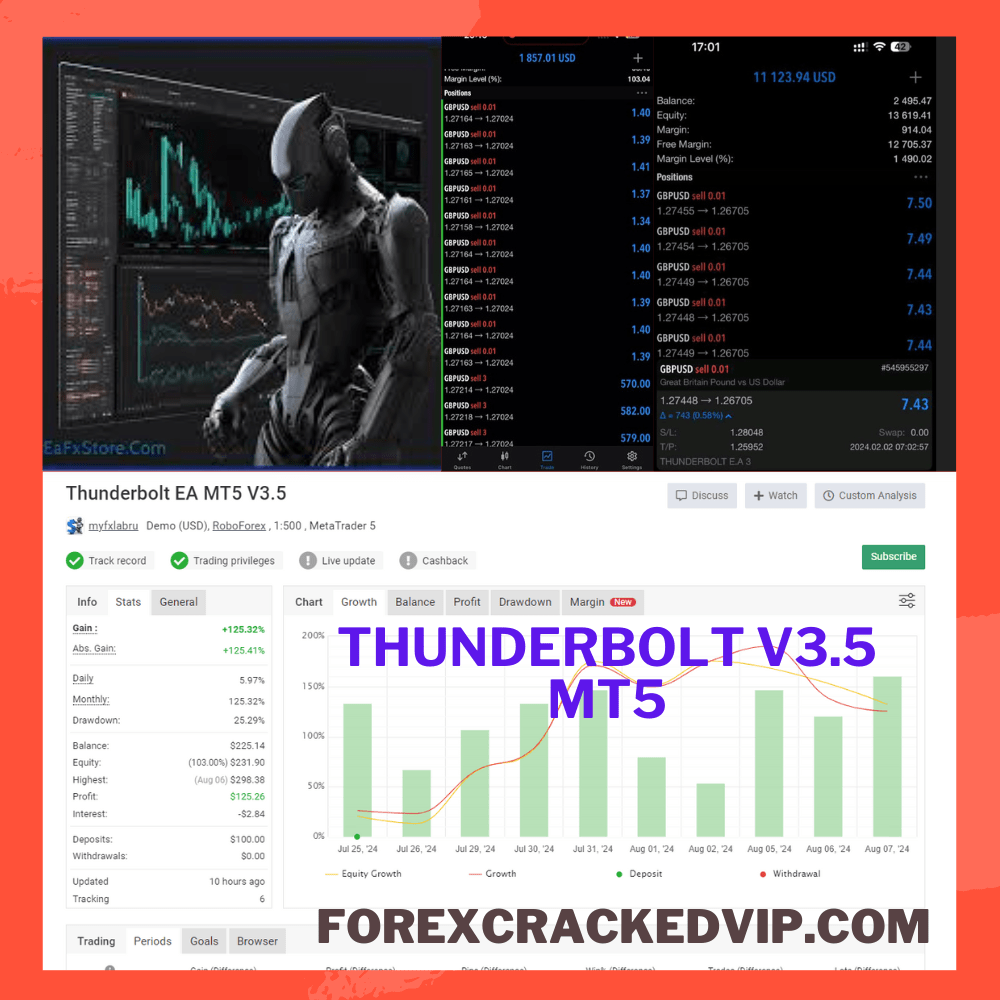

Best Selling Products

-

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$599.00Original price was: $599.00.$0.00Current price is: $0.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$24.99Current price is: $24.99. -

Rated 5.00 out of 5 based on 1 customer ratingSale!

Rated 5.00 out of 5 based on 1 customer ratingSale!$999.00Original price was: $999.00.$17.99Current price is: $17.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,599.00Original price was: $1,599.00.$39.99Current price is: $39.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$55.00Current price is: $55.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,399.00Original price was: $1,399.00.$24.99Current price is: $24.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,299.00Original price was: $1,299.00.$55.00Current price is: $55.00.