🔍 How to Backtest a Forex EA Correctly in MT4/MT5 – The Complete Guide (2025)

If you’re using a Forex EA (Expert Advisor), backtesting is one of the most important steps before trading live. A proper backtest helps you understand how your EA performs under different market conditions — revealing its strengths, weaknesses, and profitability.

In this article, we’ll explain how to backtest a Forex EA correctly in MT4/MT5, the common mistakes to avoid, and how to get the most accurate results using the tools available on ForexCrackedVIP.

🧠 What Is Backtesting?

Backtesting is the process of testing your Forex robot or trading strategy using historical data to see how it would have performed in the past.

A proper backtest gives you:

- A clear view of potential profitability

- Understanding of maximum drawdown and risk

- Confidence in your EA before live trading

You can perform backtests directly inside MetaTrader 4 (MT4) or MetaTrader 5 (MT5) — both platforms fully support automated trading through EAs.

👉 Explore our collection of verified MT4 EAs and MT5 EAs that you can backtest right now.

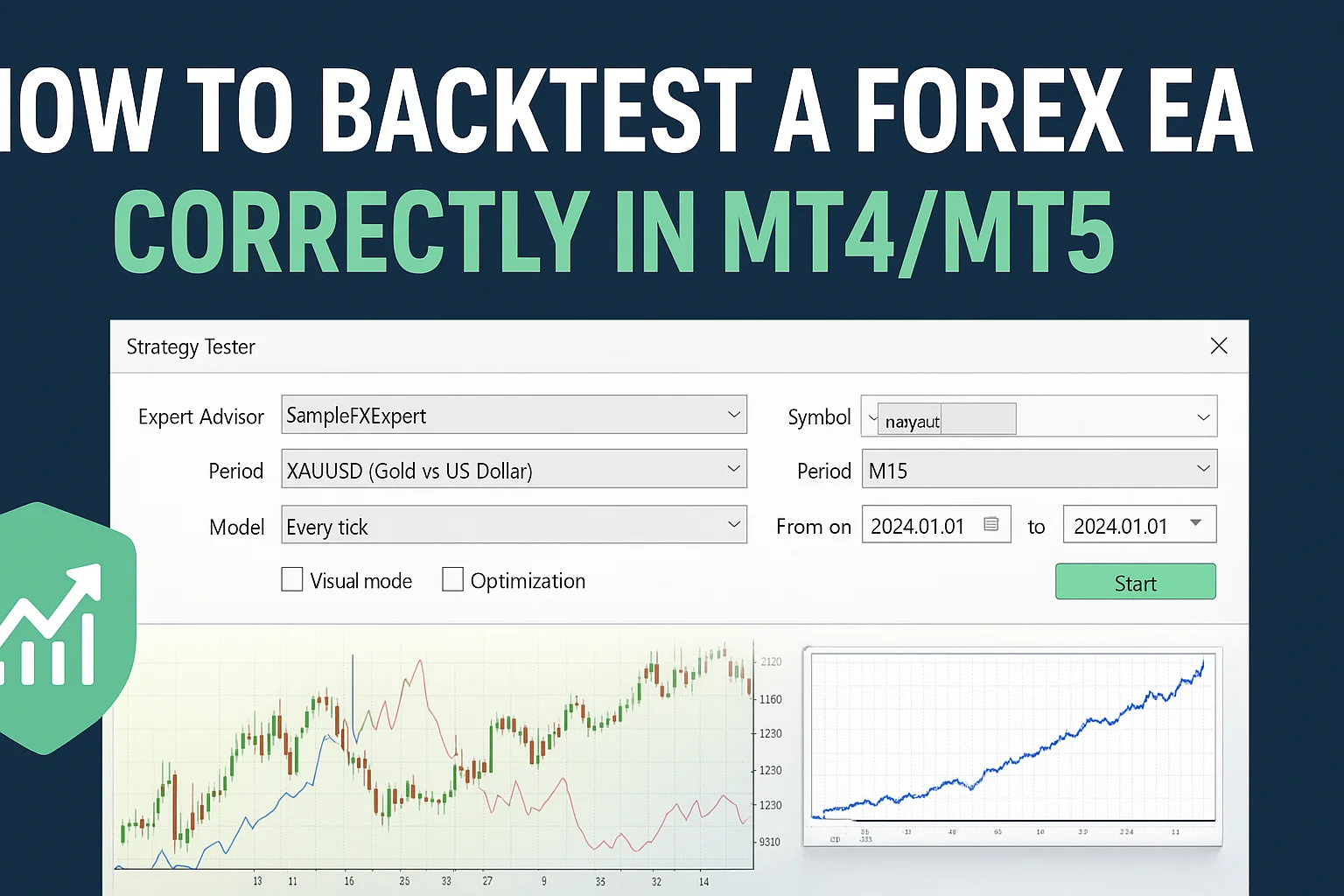

⚙️ Step-by-Step Guide: How to Backtest a Forex EA in MT4

Follow these steps to perform a perfect backtest in MetaTrader 4:

Step 1: Open the Strategy Tester

- Go to View → Strategy Tester or press Ctrl + R.

- Select your EA from the dropdown list.

Step 2: Choose the Currency Pair & Timeframe

- Select the symbol (e.g., XAUUSD, EURUSD, or GBPUSD) that your EA is designed for.

- Choose a suitable timeframe (e.g., M15, H1, or H4) depending on the EA’s trading logic.

Step 3: Select the Model

- Choose “Every tick” for the most accurate results.

- This uses the smallest data points for realistic trade simulation.

Step 4: Load the EA Parameters

- Click on “Expert properties” and adjust:

- Lot size

- Stop loss & Take profit

- Risk settings

- Trading sessions

If your EA includes a set file, load it here. You can find optimized set files for many robots on ForexCrackedVIP.com.

Step 5: Choose the Testing Period

- Select a minimum of 1–2 years of historical data to test various market conditions.

Step 6: Start and Review the Results

- Click Start to run the backtest.

- Once complete, review the report for profit factor, drawdown, trades won/lost, and balance curve.

For visual performance charts, check your EA’s verified results on Myfxbook.

⚙️ How to Backtest in MT5 (MetaTrader 5)

MT5 provides more powerful tools than MT4 for backtesting, including multi-threaded processing and tick-by-tick modeling.

Steps are similar but with added benefits:

- Faster optimization using multiple cores

- Real tick data accuracy

- Forward testing options

Simply go to View → Strategy Tester → Expert Advisor, select your EA, and follow the same steps as above.

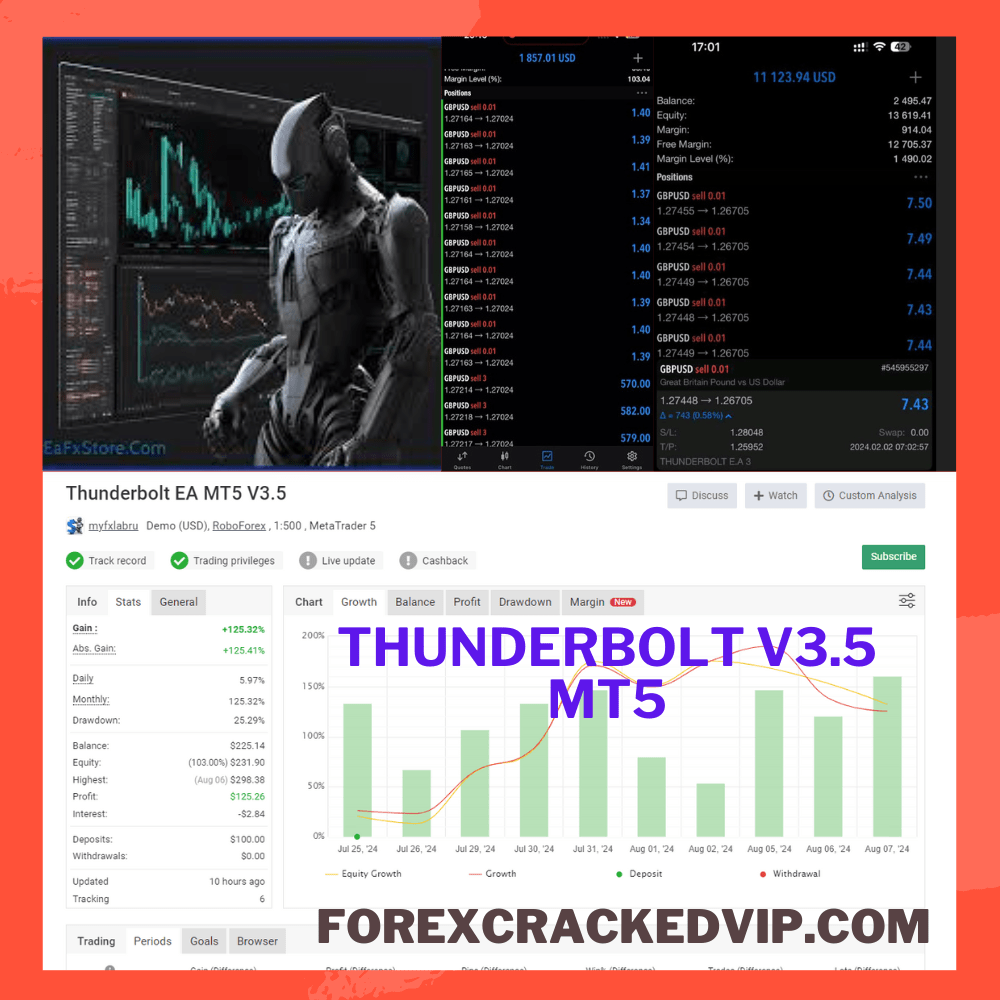

Many traders prefer MT5-compatible EAs like:

These are optimized for real-tick backtesting and accurate live performance.

📈 Tips for Accurate Backtesting

To get realistic results, follow these best practices:

✅ Use high-quality historical data (99% modeling accuracy)

You can import tick data from sources like Dukascopy or TrueFX.

✅ Enable “Visual Mode”

This allows you to see how your EA opens and closes trades in real time.

✅ Use Realistic Spreads & Slippage

Avoid zero-spread tests — they create fake results.

✅ Test Different Timeframes & Pairs

Check if your EA performs consistently across multiple conditions.

✅ Analyze Drawdown and Risk

Even a profitable EA can fail if it has high drawdown. Look for low drawdown EAs for safer trading.

💡 Why Backtesting Matters Before Live Trading

Backtesting helps you filter out bad EAs before risking real money.

It’s the best way to ensure your strategy is profitable, stable, and aligns with your risk profile.

For example:

- The Lock30x Gold Scalper Robot performs best on M15 XAUUSD with low drawdown.

- The AGI EA MT4 excels in swing trading setups with a balanced risk-return ratio.

- The Zeus Gold Hedge EA is ideal for long-term stability.

Testing these before going live will help you avoid surprises and fine-tune your trading strategy.

🧩 Bonus: Optimize Your EA After Backtesting

After completing your backtest:

- Identify the most profitable settings (lot size, timeframe, pairs).

- Run forward testing on a demo account for at least 2–3 weeks.

- Once satisfied, go live with a reliable VPS to ensure 24/7 uptime.

If you need help, our setup support team is always available → @MY4systemsofficial

🚀 Final Thoughts

Knowing how to backtest a Forex EA correctly in MT4 and MT5 is essential for becoming a successful automated trader.

It allows you to understand how your EA behaves, measure its risk, and refine your strategy for consistent profits.

At ForexCrackedVIP, we provide:

- Verified Forex EAs

- Advanced Forex Indicators

- Ready-to-use set files

- Real performance results on Myfxbook

Start your trading journey today with tested, low drawdown systems and make smarter, data-backed trading decisions.

💬 Setup Support: @MY4systemsofficial

🎁 Free EA Downloads: ForexCracked VIP Membership

About admin

Best Selling Products

-

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$599.00Original price was: $599.00.$0.00Current price is: $0.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$24.99Current price is: $24.99. -

Rated 5.00 out of 5 based on 1 customer ratingSale!

Rated 5.00 out of 5 based on 1 customer ratingSale!$999.00Original price was: $999.00.$17.99Current price is: $17.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,599.00Original price was: $1,599.00.$39.99Current price is: $39.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$55.00Current price is: $55.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,399.00Original price was: $1,399.00.$24.99Current price is: $24.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,299.00Original price was: $1,299.00.$55.00Current price is: $55.00.