How Forex Robots Work in MT4 & MT5 (Complete Technical Guide 2026)

How Forex Robots Work in MT4 & MT5

There’s a quiet shift happening in the forex market.

While most retail traders are glued to charts, reacting to candles and second-guessing entries, thousands of automated systems are executing trades with zero hesitation.

- No fear.

- No greed.

- No revenge trading. Just logic.

Forex robots in MetaTrader 4 (MT4) and MetaTrader 5 (MT5) don’t guess. They calculate.

And once you understand how they actually work, you stop seeing them as magic software – and start seeing them as programmable trading machines.

But here’s the truth most traders never realize: A forex robot is only as powerful as the logic behind it.

Let’s break it down properly.

➡️ Telegram Support: Join for updates, announcements, and support

➡️ What Is a Forex EA ?: Read First

Deep Problem Framing

Most traders struggle with three core issues:

-

Emotional decision-making

-

Inconsistent strategy execution

-

Poor risk control

Even if you know a profitable setup, can you execute it perfectly every single time?

Probably not.

That’s where forex robots come in – not as shortcuts to riches, but as discipline automation tools.

However, many traders install an EA (Expert Advisor) without understanding:

-

How it reads the market

-

How it sends orders

-

How it manages risk

-

How MT4 and MT5 process trades differently

And that ignorance is expensive.

So let’s clarify everything.

What Is a Forex Robot? (Advanced Definition)

A forex robot – also called an Expert Advisor (EA) – is a programmable trading algorithm that operates inside MT4 or MT5.

Technically, it is:

A script written in MQL4 (for MT4) or MQL5 (for MT5) that monitors price data and executes trades automatically based on predefined logic.

It does not “predict” the market.

It reacts to conditions coded into it.

Key components:

-

Market data reader

-

Strategy logic engine

-

Trade execution module

-

Risk management algorithm

Understanding these layers is crucial.

Core Mechanism Explained

Let’s simplify the internal workflow.

When you attach a forex robot to a chart:

1️⃣ Market Data Input

The EA continuously reads:

-

Current bid/ask prices

-

Candle data (Open, High, Low, Close)

-

Indicator values

-

Spread

-

Time filters

MT4 and MT5 feed this data tick-by-tick.

2️⃣ Strategy Condition Evaluation

Every new tick triggers:

IF condition A = true

AND condition B = true

AND risk rules = valid

THEN open trade

This is pure logic execution.

No hesitation. No second thoughts.

3️⃣ Order Execution Engine

When conditions are met, the robot sends:

-

Market order

-

Pending order

-

Stop loss

-

Take profit

MT5 has a more advanced execution model compared to MT4, including:

-

Netting & hedging modes

-

Depth of Market integration

-

Faster multi-thread processing

4️⃣ Trade Management

After entry, the EA may:

-

Trail stop loss

-

Close partial positions

-

Move to break-even

-

Add grid positions

-

Apply martingale logic

This is where risk profiles vary massively.

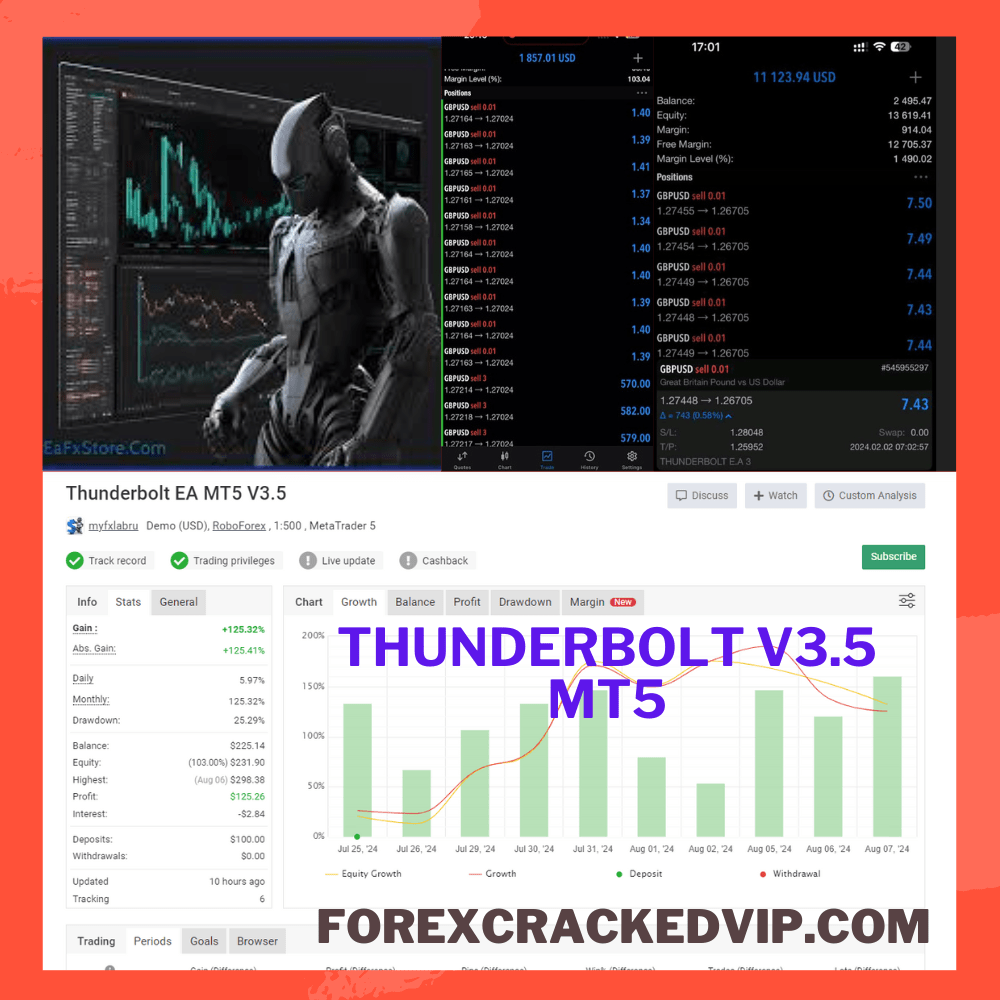

Best Perform MT4 & MT5

-

VIGRO PRO V5 EA MT4 – Advanced XAUUSD | Download Now

-

Inova Prime EA MT4 – Hybrid Order Block & Smart Martingale | Download Now

-

The One EA MT5 – Smart Trend & Recovery Trading Robot for MT5 | Download Now

-

TrendMaster FX MT5 – AI-Powered Trend Trading | Download Now

Strategic Feature Breakdown

Not all forex robots are built the same. Here’s how most systems are structured:

Entry Logic

-

Moving average crossover

-

RSI divergence

-

Breakout detection

-

News filter triggers

-

Price action pattern recognition

Risk Management Model

-

Fixed lot size

-

Percentage risk per trade

-

Dynamic lot scaling

-

Martingale multiplier

-

Grid recovery model

Time & Session Filters

-

London session only

-

New York open volatility

-

Asian range breakout

-

Weekend trade blocker

Trade Control System

-

Max daily drawdown stop

-

Max open trades limit

-

Spread filter protection

-

Slippage control

The difference between a safe EA and a blown account usually lies here.

Tactical Real-World Example

Imagine this scenario:

EURUSD on H1 timeframe.

Robot logic:

-

200 EMA trend filter

-

RSI below 30

-

Bullish engulfing candle

If all three align → Buy trade triggered.

Stop loss = 25 pips

Take profit = 50 pips

Risk per trade = 1%

Now multiply that logic over 10 currency pairs, 24/5, without emotional fatigue.

That’s automation power.

Benefits With Reasoning

1️⃣ Emotional Elimination

Robots don’t panic. They execute logic exactly as coded.

2️⃣ Speed Advantage

They react within milliseconds to price changes.

3️⃣ Multi-Chart Scalability

One trader can manage 20 pairs simultaneously.

4️⃣ Backtesting Capability

MT4 & MT5 allow historical testing before live trading.

5️⃣ Consistency

The same setup is executed identically every time.

Consistency is what most traders lack.

Risk & Limitation Analysis

Let’s be realistic.

Forex robots are not flawless.

1. Market Regime Changes

A strategy built for trending markets fails in ranging markets.

2. Over-Optimization

Backtests can look perfect but fail live.

3. Broker Conditions

High spreads destroy scalping EAs. | Recommended Brokers

4. VPS Dependency

Without stable hosting, performance drops. | Recommended VPS

5. Poor Risk Logic

Martingale systems can wipe accounts fast.

Automation doesn’t remove risk – it magnifies strategy quality.

Common Strategic Mistakes

Most traders:

-

Buy EAs without understanding logic

-

Use default settings blindly

-

Ignore drawdown history

-

Run robots on low-quality brokers

-

Change settings emotionally

Ironically, they automate strategy – but not their own discipline.

Advanced Optimization Insights

If you want real performance improvement:

- Forward test before going live

- Use high-quality tick data for backtesting

- Avoid aggressive martingale scaling

- Monitor max drawdown percentage

- Run robots on a low-latency VPS

- Diversify strategy types

The edge isn’t in owning one robot.

It’s in structured portfolio automation.

People Also Ask

1. Do forex robots really work?

Yes – if the underlying strategy has a statistical edge and risk is controlled.

2. Are MT5 robots better than MT4?

MT5 allows more advanced order handling and faster testing, but strategy quality matters more than platform.

3. Can I run multiple EAs at once?

Yes, across different charts and currency pairs.

4. Do forex robots guarantee profit?

No. They automate logic. They do not eliminate risk.

5. Is coding knowledge required?

Not necessarily, but understanding strategy logic is highly recommended.

Frequently Asked Questions (FAQ)

1. How does a forex robot decide when to trade?

It follows programmed conditions based on indicators, price patterns, or mathematical models.

2. What programming language is used for MT4 robots?

MQL4.

3. What language does MT5 use?

MQL5.

4. Can forex robots trade crypto?

Yes, if your broker provides crypto symbols on MT4 or MT5.

5. Do I need to keep my computer on?

Yes, unless you use a VPS.

Final Thoughts

Forex robots in MT4 and MT5 are not money machines.

They are execution engines. When combined with:

-

Sound strategy

-

Controlled risk

-

Proper testing

-

Stable infrastructure

They become powerful trading allies. If you’re serious about algorithmic trading.

About William S

Best Selling Products

-

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$599.00Original price was: $599.00.$0.00Current price is: $0.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$24.99Current price is: $24.99. -

Rated 5.00 out of 5 based on 1 customer ratingSale!

Rated 5.00 out of 5 based on 1 customer ratingSale!$999.00Original price was: $999.00.$17.99Current price is: $17.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,599.00Original price was: $1,599.00.$39.99Current price is: $39.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$55.00Current price is: $55.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,399.00Original price was: $1,399.00.$24.99Current price is: $24.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,299.00Original price was: $1,299.00.$55.00Current price is: $55.00.