Can Forex Robots Really Make Money? The Truth Traders Need to Know

Can Forex Robots Really Make Money ?

The idea sounds almost magical.

Install a robot.

Let it trade automatically.

Wake up to profits.

But here’s the real question every smart trader asks:

Can forex robots really make money – or is it just marketing hype?

In this in-depth guide, we’ll break down:

-

How forex robots actually work

-

When they make money (and when they don’t)

-

Real-world examples

-

The biggest risks

-

How to choose a profitable EA

-

What most sellers don’t tell you

If you’re serious about automated trading, this article will save you time, money, and frustration.

➡️ Telegram Support: Join for updates, announcements, and support

What Is a Forex Robot?

A forex robot, also known as an Expert Advisor (EA), is automated trading software that executes trades based on pre-programmed rules.

Most robots operate on:

These platforms allow traders to install EAs that:

-

Analyze price data

-

Identify trade setups

-

Open and close positions automatically

-

Manage risk using stop-loss and take-profit

In simple terms:

A forex robot follows logic, not emotions.

And that’s both its biggest strength – and weakness.

Best Money Making Robots

-

Evara MT5 EA – Advanced AI-Driven EA for MT5 | Download Now

-

NorthEastWay MT5 – MYFXBook +563% + SetFile | Download Now

-

LittleCrazy MT5 – MYFXBook +355524% Income | Download Now

How Do Forex Robots Make Money?

Forex robots make money by exploiting specific market conditions. But they do NOT “predict” the future.

They typically rely on:

1. Trend-Following Strategies

-

Buy in uptrends

-

Sell in downtrends

-

Use moving averages, RSI, MACD

2. Scalping Strategies

-

Take small profits (5–15 pips)

-

Trade frequently

-

Often used on lower timeframes

3. Grid or Martingale Systems

-

Increase position size after losses

-

Aim to recover drawdown

-

High risk, high danger

4. Breakout Systems

-

Enter when price breaks support/resistance

-

Often used during high volatility

Some robots combine multiple strategies.

But here’s the truth:

A robot only performs well in the market condition it was designed for.

When conditions change, performance can drop fast.

Can Forex Robots Really Make Money Long Term?

Let’s answer the core question directly.

📌 Yes – BUT under specific conditions.

Forex robots can make money if:

-

They use strong risk management

-

They are tested across multiple market cycles

-

They avoid dangerous martingale systems

-

They adapt to volatility changes

-

They are run on proper VPS hosting

However…

Most retail traders lose money because they:

-

Buy based on hype

-

Ignore drawdown

-

Use high leverage

-

Don’t understand the strategy

The robot isn’t always the problem.

Often, it’s unrealistic expectations.

People Also Ask: Are Forex Robots Profitable?

This is one of the most searched questions.

The honest answer:

Some are profitable. Most are not.

The market is highly competitive. If consistent, guaranteed profits were easy, everyone would be rich.

What separates profitable robots from scams?

| Profitable EA | Risky/Scam EA |

|---|---|

| Verified live results | Only backtests shown |

| Low drawdown | 70%+ drawdown |

| Realistic monthly returns (5–15%) | Claims 100% per month |

| Clear strategy logic | “Secret AI formula” |

| Transparent risk settings | Hidden lot multipliers |

If you see extreme promises, walk away.

What Is the Average Return of a Forex Robot?

Another popular PAA question.

A realistic expectation for a solid EA:

-

5%-15% monthly

-

Max drawdown under 30%

-

Consistent equity growth

Anything above that usually comes with higher risk.

If someone promises 50% per month “guaranteed” – it’s either:

-

High-risk martingale

-

Curve-fitted backtest

-

Short-term strategy that will blow up

Why Do Most Forex Robots Fail?

Let’s talk about the uncomfortable truth.

1. Over-Optimization (Curve Fitting)

Developers test robots on past data until it looks perfect.

But past performance ≠ future results.

2. Market Conditions Change

What works in a trending market may fail in ranging markets.

3. Poor Risk Management

Some robots risk:

-

5-10% per trade

-

Increase lot sizes after losses

That’s a disaster waiting to happen.

4. Broker Differences

Spread, slippage, and execution speed affect performance.

5. Trader Misuse

Even a good robot fails when traders:

-

Change settings randomly

-

Increase lot sizes emotionally

-

Run it on small accounts with high leverage

Real-World Example: Two Traders, Two Outcomes

Let’s compare two real scenarios.

📌 Trader A (Disciplined)

-

$2,000 account

-

Risk: 1% per trade

-

VPS hosting

-

10% average monthly return

After 12 months:

≈ $6,200+

Slow. Steady. Sustainable.

📌 Trader B (Aggressive)

-

$1,000 account

-

High-risk settings

-

0.5 lot per trade

-

Martingale enabled

Month 1: +40%

Month 2: +25%

Month 3: Account blown

Same robot. Different mindset.

The difference?

Risk control.

Are Forex Robots Better Than Manual Trading?

It depends on the trader.

Advantages Over Manual Trading

-

No emotional decisions

-

24/5 trading

-

Faster execution

-

Backtestable logic

Disadvantages

-

No adaptability unless coded

-

Vulnerable to market regime shifts

-

Requires monitoring

-

Needs technical setup

The best approach?

Combine automation with human oversight.

Smart traders monitor their robots like portfolio managers.

Building a Safe EA Strategy

Let’s say you’re developing a Forex EA for your trading blog or SaaS project.

A safe framework would include:

Strategy Logic

-

Trend confirmation on H1

-

Entry on M15 pullback

-

ATR-based stop loss

-

Fixed 1:2 risk-reward

Risk Model

-

Max 1% per trade

-

Daily drawdown limit

-

Weekly loss cap

Filters

-

News filter

-

Spread filter

-

Volatility filter

This type of structure is far more sustainable than grid or martingale systems. If you’re selling EAs, this approach builds long-term customer trust – and repeat buyers.

What Most Forex Robot Sellers Don’t Tell You

Here’s the part rarely discussed.

-

Many robots work for 6–12 months… then fail.

-

Some vendors replace blown accounts with new ones to show “fresh” performance.

-

Backtests can be manipulated.

-

High win rate doesn’t mean safe.

A robot with:

-

95% win rate

-

1:10 risk-reward

… is dangerous.

One loss can erase weeks of profits.

How to Choose a Profitable Forex Robot

If you’re serious about making money, follow this checklist:

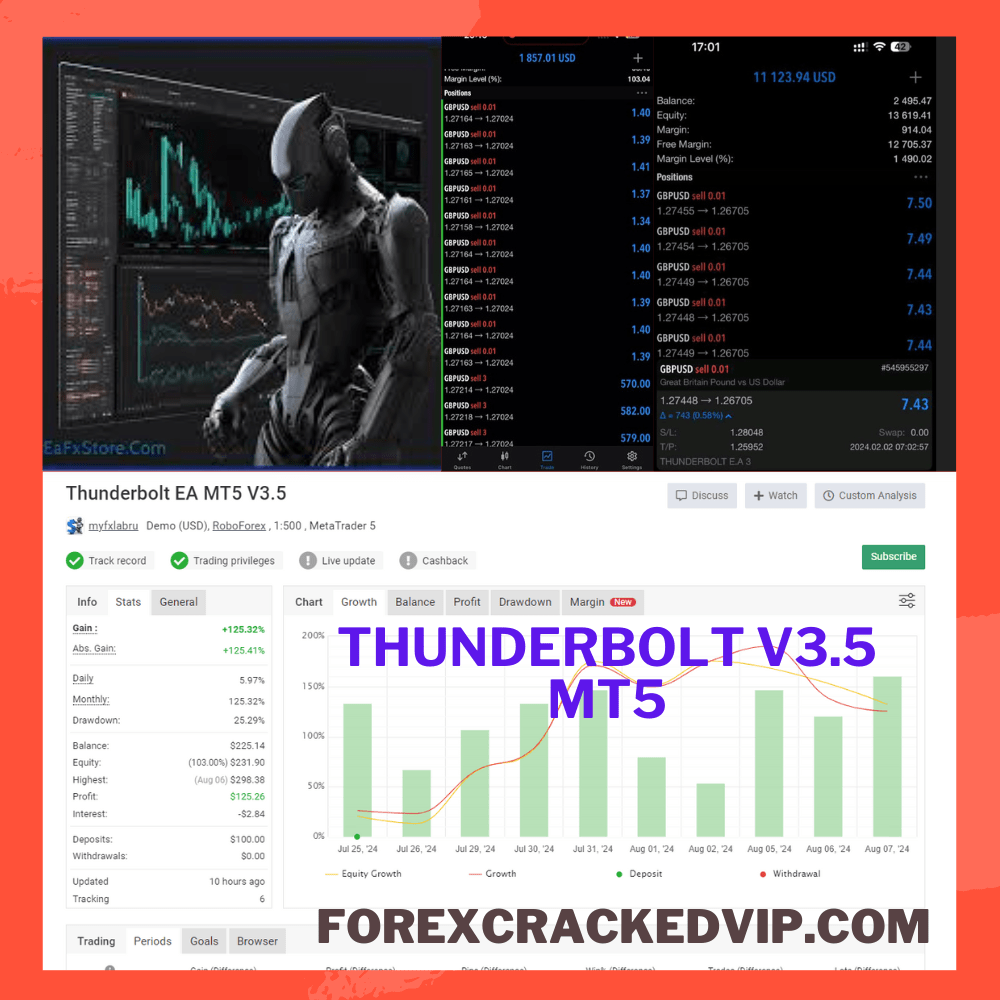

✅ 1. Check Verified Live Results

Look for:

-

6+ months history

-

Low drawdown

-

Realistic gains

✅ 2. Understand the Strategy

Avoid “black box” systems.

✅ 3. Avoid Martingale & Grid

Unless you understand the risk completely.

✅ 4. Test on Demo First

Minimum 30–60 days.

✅ 5. Use a VPS

Ensures:

-

24/7 uptime

-

Low latency

-

Stable execution

✅ 6. Start With Small Capital

Never risk money you cannot afford to lose.

Can Beginners Make Money With Forex Robots?

Yes – but only if they:

-

Learn basic risk management

-

Avoid high leverage

-

Don’t chase unrealistic profits

-

Stay patient

Forex robots are tools.

They are not magic machines.

Just like a gym membership doesn’t guarantee fitness, an EA doesn’t guarantee profit.

The Psychological Advantage of Automation

One overlooked benefit:

Automation removes emotional bias.

No fear.

No revenge trading.

No impulsive decisions.

This alone can improve long-term results — if the strategy is solid.

Are Forex Robots Worth It?

If you expect:

-

Passive income with zero monitoring

-

Guaranteed profits

-

No drawdown

Then no – they are not worth it.

But if you want:

-

Structured, rule-based trading

-

Portfolio diversification

-

Controlled automation

Then yes – they can be powerful tools.

Who Should Use Forex Robots?

Best suited for:

-

Busy professionals

-

Traders who lack discipline

-

Portfolio managers

-

Bloggers building EA review platforms

-

SaaS developers integrating automated trading solutions

If you’re running a Forex blog or selling EAs, transparency and realistic expectations will outperform hype marketing long-term.

Can Forex Robots Really Make Money?

Yes.

But only when:

-

Risk is controlled

-

Expectations are realistic

-

The strategy is robust

-

Market conditions are respected

-

The trader stays disciplined

Forex robots are not scams by default.

Bad expectations are.

Want to Use Forex Robots the Smart Way?

If you’re serious about automated trading:

-

Start small

-

Test thoroughly

-

Track performance

-

Focus on risk management

-

Avoid emotional decision-making

And remember:

Slow growth beats fast destruction.

Automation is a tool.

Your discipline determines the outcome.

- Pros and Cons of Automated Forex Trading: A Complete Guide | Read First

-

How Forex Robots Work in MT4 & MT5 (Complete Technical Guide) | Read First

-

What Is a Forex EA? Complete Beginner Guide to Expert Advisors | Read First

——————————————————————————————–

You can download the EA instantly from our website.

Want unlimited access to 500+ premium Forex robots?

👉 Become a VIP Member:

🔗 https://forexcrackedvip.com/memberships/

VIP Members get:

- Unlimited EA downloads

- Premium indicators

- Lifetime access

- Weekly updates

- Priority support

Frequently Asked Questions (FAQ)

1. Can forex robots really make money consistently?

Yes, but only with proper risk management and realistic expectations. Most sustainable EAs generate 5–15% monthly with controlled drawdown.

2. Are forex robots profitable for beginners?

They can be, but beginners must understand leverage, lot sizing, and risk control before using automated trading systems.

3. How much money do I need to start using a forex robot?

Most traders start with $500–$2,000. However, lower risk per trade is more important than account size.

4. Do forex robots work on MetaTrader 4 and MetaTrader 5?

Yes. Most Expert Advisors are built for MetaTrader 4 and MetaTrader 5 platforms.

5. Why do many forex robots blow accounts?

Because of high-risk strategies like martingale, over-leverage, and poor risk management.

About William S

Best Selling Products

-

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$599.00Original price was: $599.00.$0.00Current price is: $0.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$24.99Current price is: $24.99. -

Rated 5.00 out of 5 based on 1 customer ratingSale!

Rated 5.00 out of 5 based on 1 customer ratingSale!$999.00Original price was: $999.00.$17.99Current price is: $17.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$55.00Current price is: $55.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,599.00Original price was: $1,599.00.$39.99Current price is: $39.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,399.00Original price was: $1,399.00.$24.99Current price is: $24.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$19.99Current price is: $19.99.