Blox EA MT4 Settings Review – Trading Parameters Explained for Real Traders

lox EA MT4 Settings Review

Automated trading is no longer a luxury-it’s a necessity for traders who want consistency without staring at charts all day. Yet, one of the biggest frustrations traders face isn’t finding a Forex EA—it’s configuring it correctly. Many promising systems fail simply because traders don’t understand the settings behind them.

This Blox EA MT4 settings review focuses on what actually matters: trading parameters, strategy logic, and risk control-explained in a practical, trader-first way. Instead of sales talk, this guide breaks down how to use the EA efficiently, avoid common mistakes, and apply settings that align with real trading goals.

➡️ Buy Blox EA MT4: Now Available| Buy Now and Trade Unlimited

➡️ Telegram Support: Join for updates, announcements, and support

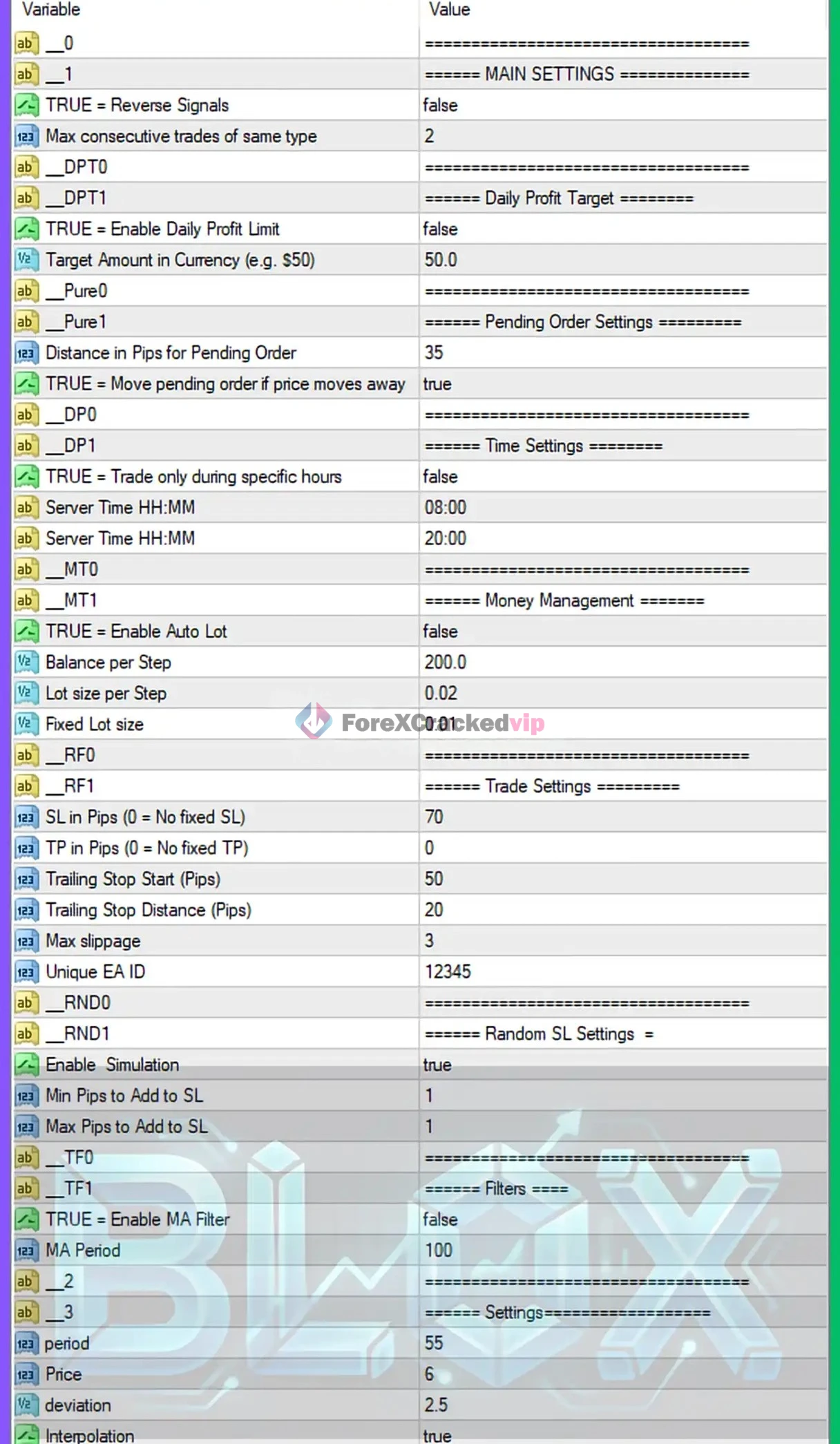

Blox EA MT4 setting Panel

Industry Challenges Traders Face Before Using EAs

Before adopting tools like Blox EA, most traders struggle with:

-

Emotional overtrading during volatile sessions

-

Inconsistent risk exposure across trades

-

Poor timing caused by manual execution delays

-

Over-optimized strategies that fail in live markets

-

Complex EAs that look powerful but confuse beginners

These issues don’t come from lack of effort—they come from poor system structure and unclear settings.

Why Most Common Solutions Fail

Many Forex robots promise “set and forget” results but fail in practice because:

-

Settings are too aggressive by default

-

Risk parameters aren’t aligned with account size

-

Strategy logic is unclear, causing misuse

-

Traders mix EAs without proper isolation

-

Users change parameters randomly after losses

Without understanding how parameters interact, even a solid EA can perform poorly.

How This Type of Tool Solves the Problem

A well-designed MT4 Expert Advisor like Blox EA focuses on:

-

Structured trade execution

-

Controlled exposure per position

-

Parameter-driven logic instead of emotions

-

Adaptability across sessions

-

Consistent rule-based entries and exits

When configured correctly, this type of EA removes emotional bias and replaces it with repeatable execution logic.

Blox EA MT4 – Strategy Logic Overview

Rather than chasing price movements, Blox EA relies on predefined market conditions before placing trades. The logic emphasizes:

-

Waiting for valid price zones instead of impulsive entries

-

Using pending-style logic rather than instant execution

-

Avoiding overtrading during uncertain market phases

-

Letting trades develop naturally within controlled boundaries

This approach suits traders who prefer stability over high-frequency exposure.

Blox EA MT4 – Trading Parameters Explained

Understanding parameters is critical. Here’s how traders should interpret them conceptually:

1. Lot Size Settings

Controls trade volume. Smaller accounts benefit from fixed micro-lots, while larger accounts may scale gradually.

2. Trade Frequency Controls

Limits how often the EA can trade, reducing overexposure during ranging markets.

3. Stop Loss & Take Profit Logic

Predefined exit levels ensure every trade has a clear risk and reward structure.

4. Time Filters

Helps avoid low-liquidity periods where false signals are common.

Each parameter works together. Changing one without understanding the others often leads to unstable results.

Risk Management Evaluation

One of the strongest aspects discussed in this Blox EA MT4 settings review is its approach to risk.

Key observations:

-

Risk is predefined before trade execution

-

No uncontrolled position stacking

-

Works well with conservative account growth models

-

Suitable for traders focused on capital preservation

This makes the EA particularly appealing for users who prioritize account longevity over fast profits.

Step-by-Step Setup Guide for Blox EA MT4

This is a neutral, independent tutorial based on real usage flow.

1st Step: Prepare Your MT4 Platform

-

Use a stable broker with low spreads | Recomended Brokers

-

Install MT4 on VPS or desktop | Recommended VPS

-

Ensure auto-trading is enabled

2nd Step: Attach the EA to a Chart

-

Select the recommended currency pair

-

Use standard timeframes (avoid switching frequently)

-

Load the EA onto one chart only

3rd Step: Adjust Core Settings

-

Start with conservative lot sizing

-

Keep default risk limits initially

-

Avoid modifying advanced filters without testing

4th Step: Enable Trade Permissions

-

Allow live trading

-

Enable DLL imports if required

-

Confirm smiley face appears on chart

5th Step: Monitor, Don’t Interfere

-

Let the EA execute without manual overrides

-

Review performance weekly—not daily

-

Adjust settings only after sufficient data

💡 Tip: Always test new settings on a demo account before applying them live.

📩 Free Support & Setup Help – Contact us 👉 Telegram Support

Recommended Settings (Balanced Approach)

While settings vary by account size and risk tolerance, many traders prefer:

-

Fixed low-risk lot sizing

-

One chart per account

-

Default SL/TP logic unchanged

-

No aggressive compounding

The goal is smooth equity growth, not rapid spikes.

Common Issues Traders Make

Even experienced users run into problems by:

-

Increasing lot size after a winning streak

-

Running multiple EAs on the same pair

-

Ignoring spread and execution quality

-

Changing settings emotionally after losses

-

Expecting daily profits without drawdowns

Avoiding these mistakes dramatically improves long-term results.

Practical Use Cases & Benefits

Blox EA MT4 is often used by:

-

Part-time traders with limited screen time

-

Portfolio traders diversifying strategies

-

Conservative investors seeking automation

-

Users transitioning from manual to automated trading

Benefits include:

-

Reduced emotional stress

-

Structured decision-making

-

Consistent execution logic

-

Better risk awareness

Best Practices & Pro Tips

-

Use VPS for uninterrupted execution

-

Keep a trading journal for EA performance

-

Avoid over-optimization

-

Combine with proper account management

-

Focus on monthly performance, not daily results

Final Thoughts & CTA

Understanding settings is what separates profitable EA users from disappointed ones. This Blox EA MT4 settings review shows that success doesn’t come from magic algorithms-it comes from proper configuration, patience, and discipline.

If you’re looking for a structured, risk-aware automated trading approach, you can explore the full details and access the official version through the Blox EA MT4 product page and evaluate whether it fits your trading style.

FAQs – Blox EA MT4

1. Is Blox EA MT4 suitable for beginners?

Yes, when used with conservative settings and proper risk control.

2. What is the best timeframe for Blox EA?

It performs best on stable, standard timeframes without frequent changes.

3. Can Blox EA MT4 be used on small accounts?

Yes, provided lot sizes are adjusted carefully.

4. Does Blox EA use martingale?

No aggressive recovery methods are required when configured correctly.

5. How often should I change settings?

Only after reviewing sufficient performance data—avoid frequent changes.

About William S

Best Selling Products

-

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$599.00Original price was: $599.00.$0.00Current price is: $0.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$24.99Current price is: $24.99. -

Rated 5.00 out of 5 based on 1 customer ratingSale!

Rated 5.00 out of 5 based on 1 customer ratingSale!$999.00Original price was: $999.00.$17.99Current price is: $17.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,599.00Original price was: $1,599.00.$39.99Current price is: $39.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$55.00Current price is: $55.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,399.00Original price was: $1,399.00.$24.99Current price is: $24.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,299.00Original price was: $1,299.00.$55.00Current price is: $55.00.