IC Markets Review 2026: The “Raw Spread” Broker Every Scalper Needs

IC Markets Review 2026

If you have ever opened a trade and watched it immediately start deep in the red because of a widespread, you know the frustration. In the world of forex trading, fees are the silent killer of profitability.

For years, I searched for a broker that didn’t bet against me. I didn’t want “bonuses” or flashy marketing; I just wanted my orders executed instantly at the real market price. That search led me to IC Markets.

In this IC market review, I’m going to break down why this broker is widely considered the best True ECN choice for scalpers and algorithmic traders in 2026. I’ll walk you through their spreads, regulation, and why their “Raw Spread” account might just save your trading career.

Transparency Note: I am an active trader. This review contains affiliate links. I recommend IC Markets because I personally trust their execution speed and low costs.

📌 Start Earning Profits Today – Free Register Today

📌 More Update & News – Join Telegram Chanel

Quick Verdict: Is IC Markets Worth It?

If you are short on time, here is the bottom line: Yes.

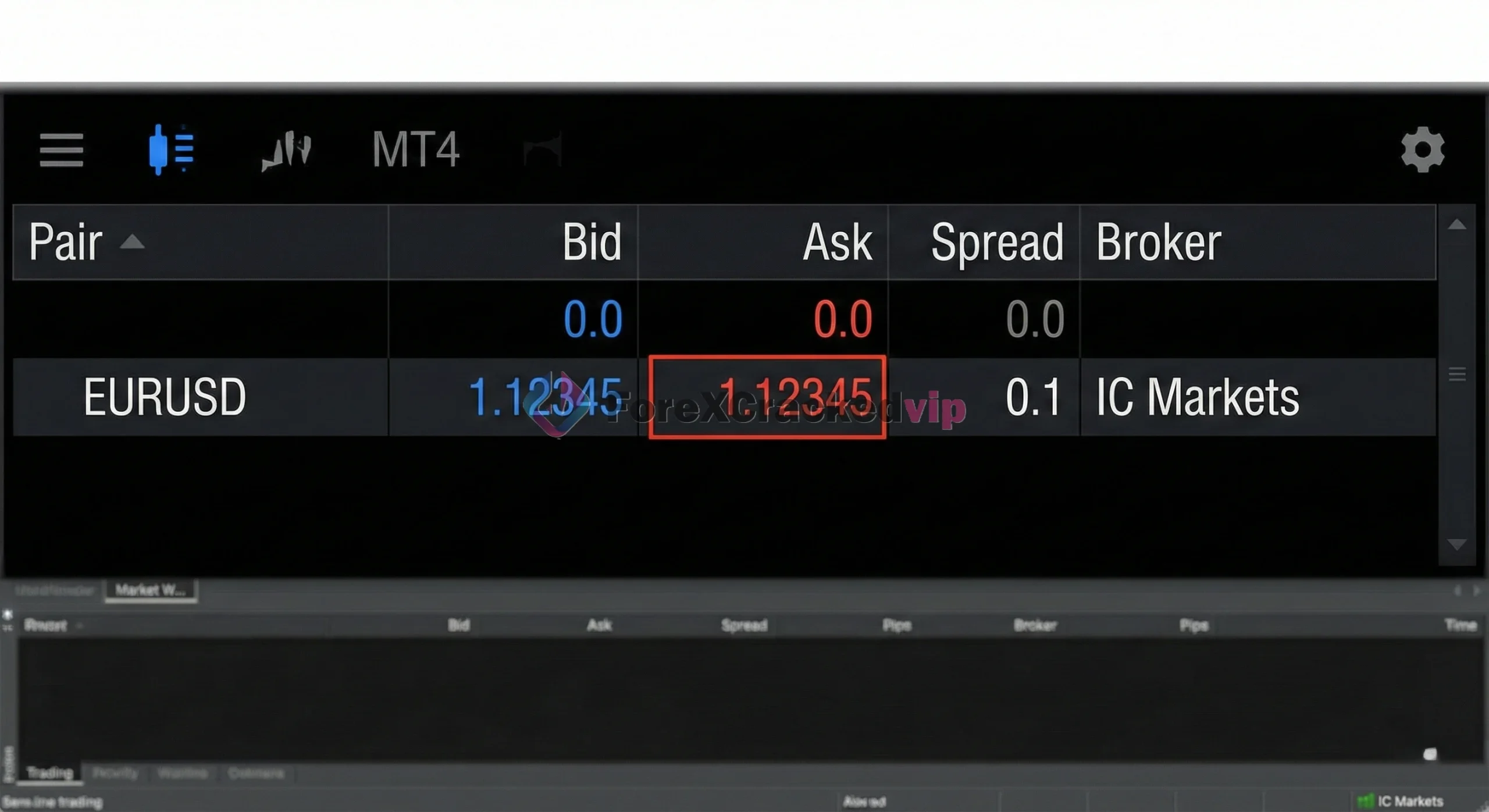

If you are an intermediate to advanced trader using MetaTrader 4, MetaTrader 5, or cTrader, IC Markets is the industry standard. Their execution speeds are among the fastest globally, and their spreads on majors like EUR/USD frequently hit 0.0 pips.

The “True ECN” Difference: Why It Matters

Most beginner brokers are “Market Makers.” This means when you buy, they sell. If you win, they lose. This creates a conflict of interest where they might widen spreads or delay your order to stop you from profiting.

IC Markets are different. They are a True ECN (Electronic Communication Network) broker.

- No Conflict of Interest: They connect your trade directly to a pool of 25+ liquidity providers (banks and hedge funds).

- Raw Pricing: They pass the market price directly to you without marking up the spread.

- How They Make Money: Instead of widening the spread, they charge a small, transparent commission (approx $3.50 per lot).

This distinction is critical for scalpers and high-volume traders. When you are scalping for 5-10 pips, you cannot afford a 2-pip spread. You need the precision of 0.0 or 0.1 pips.

IC Markets Withdrawal Review (Ranked & Tested)

One of the most common things people search for is IC Markets withdrawal problems. To be honest, most “problems” usually stem from users trying to withdraw to an account that doesn’t match their ID name (a strict anti-money laundering rule).

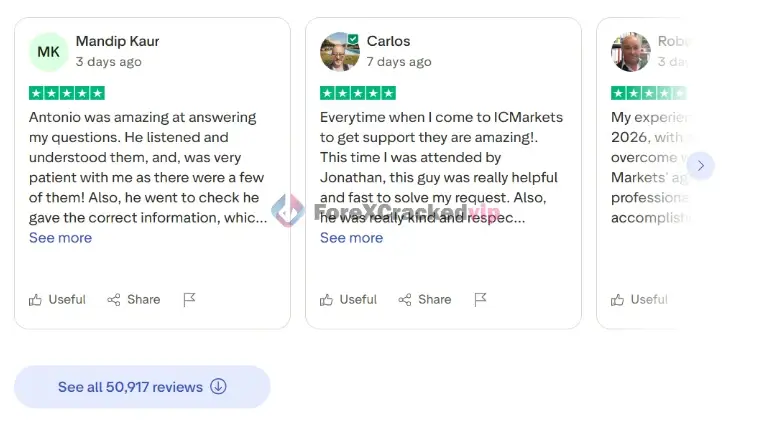

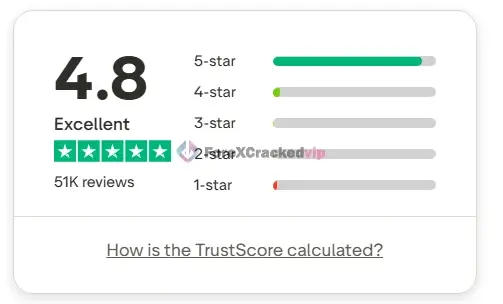

In my experience and according to thousands of IC market review Trustpilot ratings they are top-tier in this category.

- Speed: I typically receive funds back to my Skrill/Neteller account within hours. Bank wires usually take 1-3 business days.

- Reliability: They have a 4.8/5 rating on Trustpilot, which is incredibly rare for a broker. Users consistently rank them as “Excellent” for payout reliability.

- Fees: There are no withdrawal fees charged by IC Markets themselves, though your bank might charge an intermediary fee.

The Verdict on Withdrawals: If you follow the rules (verify your ID and use your own bank account), the process is seamless.

Execution Speed: The Hidden Factor

Low spreads mean nothing if you have high “slippage” (when your order fills at a worse price than you clicked).

IC Markets servers are located in the Equinix NY4 data center in New York. This is the same financial hub used by Wall Street banks.

- Latency: Average execution speed is under 40ms.

- VPS Cross-Connect: If you run trading bots, you can hook your VPS directly to their server for near-zero latency.

For news traders or those using high-frequency algorithms, this low-latency infrastructure is a non-negotiable requirement.

Account Types: Which One Should You Choose?

IC Markets offers three main account types. The image below gives you a quick comparison.

1. The Raw Spread Account (MetaTrader) – Recommended

This is the account that made IC Markets famous.

- Platform: MT4 or MT5.

- Spreads: From 0.0 pips.

- Commission: $3.50 per lot (per side).

- Best For: EAs (Expert Advisors), Scalpers, and Day Traders.

2. The cTrader Raw Spread Account

If you prefer a more modern interface over the “classic” look of MT4, cTrader is a beast.

- Platform: cTrader.

- Spreads: From 0.0 pips.

- Commission: $3.00 USD per $100k traded.

- Best For: Manual Scalpers and those who need Level II Depth of Market (DoM) data.

3. The Standard Account

- Platform: MT4 or MT5.

- Spreads: From 0.6 pips.

- Commission: None ($0).

- Best For: Discretionary/Swing traders who dislike calculating commissions separately.

How to Open an IC Markets Account (Step-by-Step Guide)

Follow this simple 5-step process to create your account and avoid common verification delays.

📌 Step 1: Visit the Official Page

Always use a verified link to ensure you land on the official site and avoid phishing scams. 👉 Click Here for the Secure Registration Link

📌 Step 2: Fill in Your Personal Details

Enter your country of residence, full name, email address, and phone number.

⚠️ Important: Ensure your name matches your ID exactly. Even a small spelling difference can cause issues with your IC Markets Login verification later.

Select your preferred trading platform:

-

MetaTrader 4 (MT4) – Best for automated trading (EAs).

-

MetaTrader 5 (MT5) – Best for stocks and modern trading.

-

cTrader – Best for manual scalping.

-

Select your base currency (USD, EUR, GBP, AUD, etc.).

📌 Step 4: Verify Your Identity (KYC)

This step is mandatory for your safety. To speed up the process, have these two documents ready to upload:

-

Photo ID: A clear copy of your Passport, Driver’s License, or National ID.

-

Proof of Residence: A utility bill or bank statement dated within the last 3 months.

-

Tip: Verification is typically approved in less than 24 hours.

📌 Step 5: Fund and Trade

Once your account is verified, you can make your first deposit. The official IC Markets minimum deposit is $200. We recommend starting with this amount to ensure you have enough free margin to handle market swings safely.

Safety & Regulation: Is IC Markets Legit?

In the online trading world, trust is everything. You should never deposit money with an unregulated broker.

IC Markets Global holds licenses with some of the strictest financial regulators in the world:

- ASIC (Australia): One of the toughest regulators globally.

- CySEC (Cyprus/Europe): Ensuring compliance with European financial standards.

- FSA (Seychelles): This license allows IC Markets Global clients to access higher IC Markets leverage (up to 1:500) compared to the restricted 1:30 leverage in Europe or Australia.

Crucially, they use Segregated Client Trust Accounts. This means your trading capital is kept in top-tier banks (like Westpac and NAB) and is completely separate from the company’s own operational funds.

Deposit and Withdrawal Methods

Getting money in and out is seamless. I have personally tested their withdrawal process multiple times, and it is consistently reliable.

- Deposit Methods: Credit/Debit Card (Instant), PayPal, Skrill, Neteller, Wire Transfer, and various Cryptocurrencies.

- Withdrawal Speed: E-wallets are usually processed same-day. Wire transfers take the standard 2-5 business days.

- Fees: IC Markets does not charge deposit or withdrawal fees (though your bank might).

The Pros and Cons

To be completely fair, here is what I love and what could be improved.

The Pros:

- ✅ Industry-Leading Spreads: Often hitting flat 0.0 on EURUSD.

- ✅ No Restrictions: Scalping, Hedging, and EAs are all welcome.

- ✅ Reliable Platforms: MT4, MT5, and cTrader are stable and fast.

- ✅ Global Trust: 4.8/5 stars on Trustpilot with few valid Ic market review complaints.

The Cons:

- ❌ Account Opening: Because they are heavily regulated, the ID verification process is strict.

- ❌ Overwhelming for Beginners: The “Raw” environment is fast-paced. They don’t offer as much “hand-holding” education as some retail brokers because they cater to serious traders.

Frequently Asked Questions (FAQ)

Q: What is the IC Markets minimum deposit?

A: The recommended minimum deposit is $200. While you might be able to deposit less technically, starting with $200 ensures you have enough free margin to trade safely.

Q: Are there any IC Markets withdrawal problems?

A: Genuine withdrawal problems are extremely rare. Most issues occur because a user tries to withdraw to a bank account in a different name, which is blocked for security reasons.

Q: What is the IC Markets leverage?

A: This depends on your region. IC Markets Global clients can access leverage up to 1:500. Clients in Australia or Europe are typically capped at 1:30 due to local laws.

Q: Is IC Markets legit or a scam?

A: They are absolutely legit. Regulated by ASIC, CySEC, and FSA, they are one of the most transparent brokers in the industry.

Final Verdict: Why I Trade with IC Markets

In 2026, you have hundreds of brokers to choose from. But if you strip away the marketing fluff and look at the raw data spreads, commission, and execution speed IC Markets remains the king of the mountain.

They have built an ecosystem where your success depends entirely on your skill, not on fighting your broker’s fees.

If you are ready to stop overpaying for spreads and start trading in a professional environment, I highly recommend giving them a try.

About Isuru Indrajith

Best Selling Products

-

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$599.00Original price was: $599.00.$0.00Current price is: $0.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$24.99Current price is: $24.99. -

Rated 5.00 out of 5 based on 1 customer ratingSale!

Rated 5.00 out of 5 based on 1 customer ratingSale!$999.00Original price was: $999.00.$17.99Current price is: $17.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,599.00Original price was: $1,599.00.$39.99Current price is: $39.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$55.00Current price is: $55.00. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$1,399.00Original price was: $1,399.00.$24.99Current price is: $24.99. -

Rated 0 out of 5Sale!

Rated 0 out of 5Sale!$999.00Original price was: $999.00.$19.99Current price is: $19.99.